As summer 2024 kicks off in earnest, the outlook for travel is strong, for the most part. But travel demand and industry performance is not spread evenly. The outlook for operators can depend on where you’re located, and what types of travelers you serve.

Very early results from Arival’s 2024 Global Operator Landscape survey suggest mixed results: while most operators said they are optimistic about their prospects in 2024, over half of operators said their bookings are the same or even below 2023 levels.

This indicates that the first half of 2024 may be off to a slower start than many had hoped. Planning is everything, and the answer to what to expect can depend on who you ask. So we took a close look at the latest data from a variety of industry sources and spoke with a number of leaders in the experiences sector to get an idea of what to expect with the latest travel trends this summer.

Here’s a few key themes that emerged:

- While travel overall is looking strong, particularly for hot spot destinations and emerging destinations like Northern Europe and Asia, there is some softness around U.S. domestic travel and Covid-boom destinations like Miami.

- Operators in North America and Europe are overall optimistic about 2024, very early results from Arival’s currently ongoing survey show. However, approximately half of operators report their booking levels for 2024 so far are the same or below 2023 levels.

- A major factor this summer, particularly among U.S. travelers, will be the growing income gap and how that is impacting travel: while affluent travelers are poised to make up a greater proportion of overall travelers, price sensitivity has returned for many, affecting luxury travel trends.

- And while some are concerned the rising costs of air travel and hotel may take a bigger bite out of the budget for experiences, traveler survey data suggests otherwise: travelers are prioritizing experiences and spending more on them per trip.

So what does all this mean for operators? Where is everyone going, how much are they willing to spend, and what are they doing when they get there? Are we finally getting “back to normal,” or are we moving beyond it?

Where Travelers are Going: Hot Spots & Alternative Destinations

Travel this summer, like the season, will be hot. There’s no doubt about that. Traveler expenditure in Europe will hit record numbers this year, and travel to the U.S. is also expected to increase by upwards of 15% over 2023. According to Expedia, “searches for summer trips are up year-over-year for flights and lodging,” with flight search data showing New York and London to be the most popular domestic and international destinations for U.S. travelers, with Rome, Paris and Tokyo not far behind.

“We are experiencing a surge in popularity, with bookings up significantly compared to previous years,” shared Oliver Mernick-Levene, Founder of Secret Food Tours. “We are seeing increases in bookings by over 45%, particularly in cities renowned for their food scenes — Paris, New York, Tokyo for example.”

“London has been the boom for us,” shared Stephen Oddo, President and Founder of Walks. “I think part of that is London is the most affordable destination right now in terms of flights. That’s part of why I think London has been doing well is, all things considered, it’s just more accessible.”

While the hot spots continue to be hot — Paris, Florence and Rome are still the most-booked destinations on Viator as we approach summer — the heat itself, as well as increased prices and crowding, are driving many to explore alternative destinations beyond the top spots.

In a growing trend towards what some are calling “coolcationing,” travelers are seeking out places that are not only less expensive and less crowded, but also less hot. Tour and activity bookings for summer 2024 in Norway, Denmark, and Sweden are surging on Viator, GetYourGuide and TourRadar, with some approaching amounts double that of last year, making them some of the top summer destinations of 2024.

“Destination dupes,” the latest Gen Z trending term for less expensive substitute spots, are becoming increasingly trendy in 2024, the BBC reported. Price-sensitive travelers want to escape the crowds of the most popular destinations, as well as to escape the prices that accompany that popularity. Destination dupes include decisions like traveling to Liverpool instead of London, Faroe Islands instead of Iceland, and Krakow instead of Rome. According to a survey by Skyscanner, “93% of travelers would consider a dupe destination, with about 64% revealing that the savings helped them decide.”

Asia is another region seeing a surge in popularity in 2024. “Asia Pacific stands out with half of the world’s top ten trending destinations,” according to the Mastercard Economic Institute (MEI). Japan in particular, with Tokyo, Osaka and Kyoto all making Expedia’s list of fastest-growing cities this summer travel season for U.S. travelers, and 5/5 of Viator’s top-rated destinations are in Asia.

Finally, many destinations that saw a boom during the Covid-19 pandemic are slowing down. “Markets that did really well during the pandemic and during the last couple of years — Miami, Tampa, Orlando — they’re really slowing down as Americans make slightly different choices. Maybe they go back to the Caribbean. Maybe they go back to Mexico,” explained Jan D. Freitag, National Director of Hospitality Analytics at CoStar. Forecasters for the U.S. hotel market have also lowered their projections for the rest of 2024 as U.S. domestic travel demand softens.

Operator Takeaway: The 2024 summer outlook depends in large part on where you are. Popular hot spots will continue to be popular this summer, while emerging destinations in Northern Europe and Asia will continue to see growth. Certain regions that got a boost during Covid from domestic travel, in the U.S. in particular, may be looking at a softer summer as travelers explore popular and emerging destinations abroad — or avoid travel altogether due to economic concerns (more on this below).

Join us at an upcoming Arival event to connect, learn, & grow your tours, activities, & attractions business

Who is Traveling: Affluent Travelers a Bright Spot as Price Sensitivity Returns

While many travelers spared no expense to travel during the post-Covid “revenge travel” phase, price sensitivity has definitely returned. The rising cost of living is having an impact: 62% of global travelers said the increased cost of living will limit their 2024 summer travel plans, according to a booking.com survey. A study by Deloitte found one in three U.S. non-travelers say travel is too expensive right now, up from one in four in 2023.

“Headwinds in the form of inflation, high interest rates, and rising debt are likely having an impact on travel, especially among middle- and lower-income Americans,” explained the latest report from CoStar, a research firm which tracks commercial real estate data, including hotel capacity, occupancy and rates.

However, while some cost-conscious travelers may be staying closer to home, others with more means are undeterred.

“The upper end of the market is doing much much better than the lower end,” said Freitag. According to CoStar data, luxury hotels have sold 4% more rooms than a year ago, while economy hotels have sold 6% less. Affluent U.S. consumers are “feeling the wealth effect.” They’re taking more summer vacations, Freitag explained.

This divide between affluent and lower-income travelers is widening. “With more low-income Americans deterred by high prices, high-income Americans are expected to make up a much bigger share of the traveling public this summer—44%, versus 35% in 2023,” according to Deloitte.

As Arival research has found, these affluent travelers make up an even greater share of experiences spend. U.S. travelers with household income of $150k or more comprise nearly half of all spend on experiences.

Operator Takeaway: With affluent travelers poised to make up a greater share of the market in 2024 — and a greater share of spend on tours, activities and attractions — you should plan for them to make up a greater share of your customer base. Explore offering more of what affluent travelers are looking for, such as private tours and options for different service-level tiers.

What Travelers Want: Experiences, Authenticity & Online, Flexible Booking

Summer travelers still prioritizing experiences despite rising costs

With the total cost of travel up, flights and hotels may take a bigger bite out of the average traveler’s budget, noted Freitag, possibly leaving less for things to do in-destination. “Total cost of travel matters, and airfare on the premium side is definitely going up,” he said. “For the average person, they have a travel budget, hotel and air is taking a bigger bite out of it.”

Some operators, too, are concerned about travelers having less travel budget left for experiences after covering transport and accommodation costs. For Monique Bayer, Owner of Walk Melbourne Tours in Australia, the uncertainty of how rising costs will affect discretionary traveler spending is a challenge. “After you book your flights and accommodation, you might not have any extra left in the budget for things like tours and experiences, if the budget is a little bit reduced for all those pressures,” Bayer said.

However, Arival research on U.S. consumer spending suggests travelers in general are still prioritizing experiences despite the rising costs. “Despite some headwinds over 2024, demand for experiences has remained strong. Travelers want more, and they are increasingly prioritizing experiences when trip planning,” stated Arival’s 2024 U.S. Experiences Traveler Outlook report.

Research from online travel agency (OTA) GetYourGuide, too, confirms this. “Consumer spending shift is clear: despite economic uncertainty, people are spending more on experiences, most notably travel activities that express personal passions.”

“People in Europe and the U.S. said absolutely, we are less prepared to ‘save’ on experiences we want to have,” explained Anna Cashman, Brand Lead at GetYourGuide and co-host of the recent Arival & GetYourGuide Traveler Trends Webinar. “Perceived negative economic environment be damned, experiences are what people are traveling for, and experiences drive travel decisions.”

Data from the Mastercard Economic Institute (MEI) supports this as well. The MEI forecasts “continued momentum as consumers prioritize meaningful experiences, allocating more of their budgets to travel,” according to the latest MEI report. “Tourists globally are prioritizing experiences and nightlife, with Australians leading in spending on these activities.”

Operator Takeaway: Travelers still want to spend on experiences, but they are dealing with the increased cost of transportation and accommodation. Tailor your products and prices to suit both affluent and price-sensitive guests, and explore ways to offer new products or tours in new destinations or “destination dupes” to appeal to price-sensitive travelers.

30 September – 3 October 2025

Insider Pro Access Members Save 20%

THE event of the year for solutions-focused In-Destination Experience creators and sellers

Get Your Spring Savings Ticket Today!

The experiences summer travelers want: authentic, immersive… and bookable online

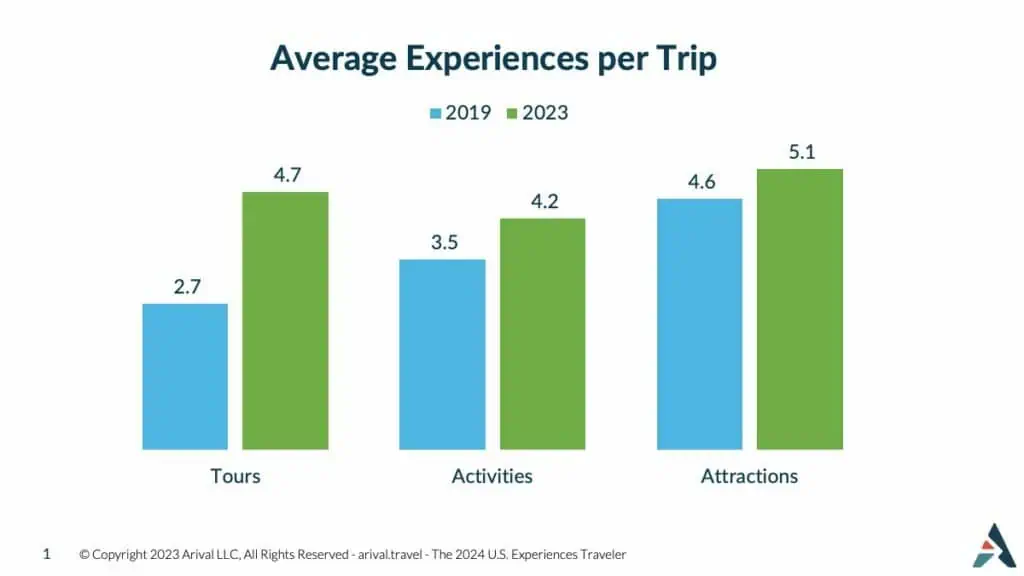

Travelers are booking more experiences, as Arival research has shown — an average of seven experiences per trip, according to the 2024 U.S. Experiences Traveler study.

So the question for operators is, how do you encourage these travelers to choose your experiences? What are these travelers looking for?

In a recent GetYourGuide survey, travelers were asked “What would make you choose to do a specific experience?” The two top answers related to online booking and flexibility, and “authentic immersive experiences.”

In terms of types of activities that appeal to travelers, for European and U.S. travelers in particular, the top four categories were workshops, private tours, multi-day trips and adventure tours.

“What they have in common essentially is that they’re immersive and they’re all about diving really deep,” Cashman explained. “Human connection and learning and going really deep on a topic, they’re all core to these types of activities… travelers are thinking more about passions and interests than ever before.”

The top themes and topics travelers mentioned were nature, water, food and culture. “I think this is a really positive data point for all manner of operators because I think all of them can speak to one of these,” said Cashman. For example, “if you host a nature experience, it’s just about making sure that you’re as immersive or authentic and you connect to the place as much as possible.”

Younger travelers, in particular, are looking for more than sightseeing. As Arival’s 2024 U.S. Tour Taker report found, younger (Millennial and Gen Z) travelers are twice as likely to do a culinary, experiential or special-interest tour and three times as likely to do an active adventure tour.

Operator Takeaways: Travelers are looking to get immersive and authentic as possible in their experiences, and they expect to be able to book these experiences online. Learn more about How to Choose a Booking System if you need guidance on how to get your experiences bookable online, and explore ways to make your experiences more immersive here. Learn more about the Arival & GetYourGuide research on summer travel trends here: U.S. & Europe Traveler Trends Webinar: Insights for a Successful Summer.

What’s Next: Back to Pre-Pandemic Norms… or Beyond?

In the aftermath of the Covid-19 pandemic, it seems for years the discourse has focused on a return to pre-pandemic norms. And while some regions are seeing a return to pre-pandemic booking levels, one thing that’s increasingly becoming clear is that there is no real “going back.”

In some regions, 2024 is seeing a return to normality, even a cooling of demand after the post-Covid “revenge travel” booking boom.

“2023 was the peak of the post-Covid boom and while we still see growth in some places, the demand surge that we saw last year at this point,” said Oddo, “now we’ve come back down to earth a bit.”

Indeed, for North America and Europe, preliminary results of Arival’s 2024 Global Operator Landscape survey suggest a cooling of demand: just over half of operators reported their 2024 bookings are the same or down compared to 2023.

For Australia and New Zealand, operators are entering their winter season. And while past winters have boomed for many, this year, so far, appears to be bringing a return to pre-pandemic (or pre-revenge travel) levels.

“We’re anticipating a return to normal seasonal patterns that we were used to before,” shared Melbourne-based Bayer. (Learn more about the outlook for this region in Arival’s latest report on The State of Experiences in Australia and New Zealand).

However, beyond booking levels themselves, it appears 2024 is not so much about going back as it is about going forward.

“It’s not going to be business as usual,” said Cashman. “Covid profoundly changed the industry on a number of fronts.” Including, for many travelers, the ability and flexibility of digitization and online booking. “I think that’s that’s a profound change that will shape our industry forever.”

Many regions are seeing an extension of the peak travel season as well, attributed to rising temperatures as well as increased price sensitivity among lower income travelers. “The summer travel season is extending,” according to the Deloitte study. “The percent of summer trips slated for post-Labor Day September has risen from 12% in 2022 to 17% in 2024.” Booking.com also found nearly half (47%) of travelers are considering taking their children out of school to travel during off-peak times.

Many companies are also changing how they do business by responding to the increased traveler demand for more sustainability. Big Bus Tours, for example, is changing their fleet to zero-emission vehicles.

“Not only is that the right thing to do,” said Alexi Tabrizi, VP of Global Sales for Big Bus Tours, “but it’s going to prove to be more profitable for us. It’s already showing to save costs once the buses are up and running.”

Finally, the rise of experiences in general as a priority for travelers — as a driver for travel and also as a priority for trip spend — is a huge boon for our sector.

But it’s not just about experiences anymore, either. “This is a very well trodden maxim, experiences over things,” observed Cashman. “I think honestly, we’re entering the 2.0 of this paradigm, where it’s not just experiences over things, but it’s experiences that… meet my passions over experiences, full stop.”

27-29 April 2026

Insider Pro Access Members Save 20%

THE event of the year for the European in-destination experiences industry

Get Your Super Early Bird Ticket through 15 July!

Learn More about the Future of Experiences at Arival

Join us at an upcoming Arival event to learn more about the outlook for the tours, activities and attractions sector, get insights on the latest industry trends and consumer research, and connect with leaders and peers in the in-destination experiences sector. We hope to see you there!

Become an Insider Pro Access member today and get access to the full library of Arival research, plus many other benefits such as free consulting sessions, special discounts and 20% off in-person events, starting from $179 per year.

Sign up to receive insights tailored for the in-destination industry as well as updates on Arival.

Header Photo: Unsplash / Simon Maage