Diversity is the name of the game among European travelers, with trends, spend and trip intentions differing by country and age group. For operators, this means understanding the nuances between the different segments is essential to attracting and serving European travelers effectively.

For The 2025 European Experiences Traveler Outlook, we surveyed 1600 European travelers from France, Germany, Spain and the U.K. This new report from the The 2025 Experiences Traveler research series delves into the state of the European experiences traveler – who they are, what they want, what they are looking for in 2025 – and some key trends shaping the tours, activities and attractions sector for the coming year.

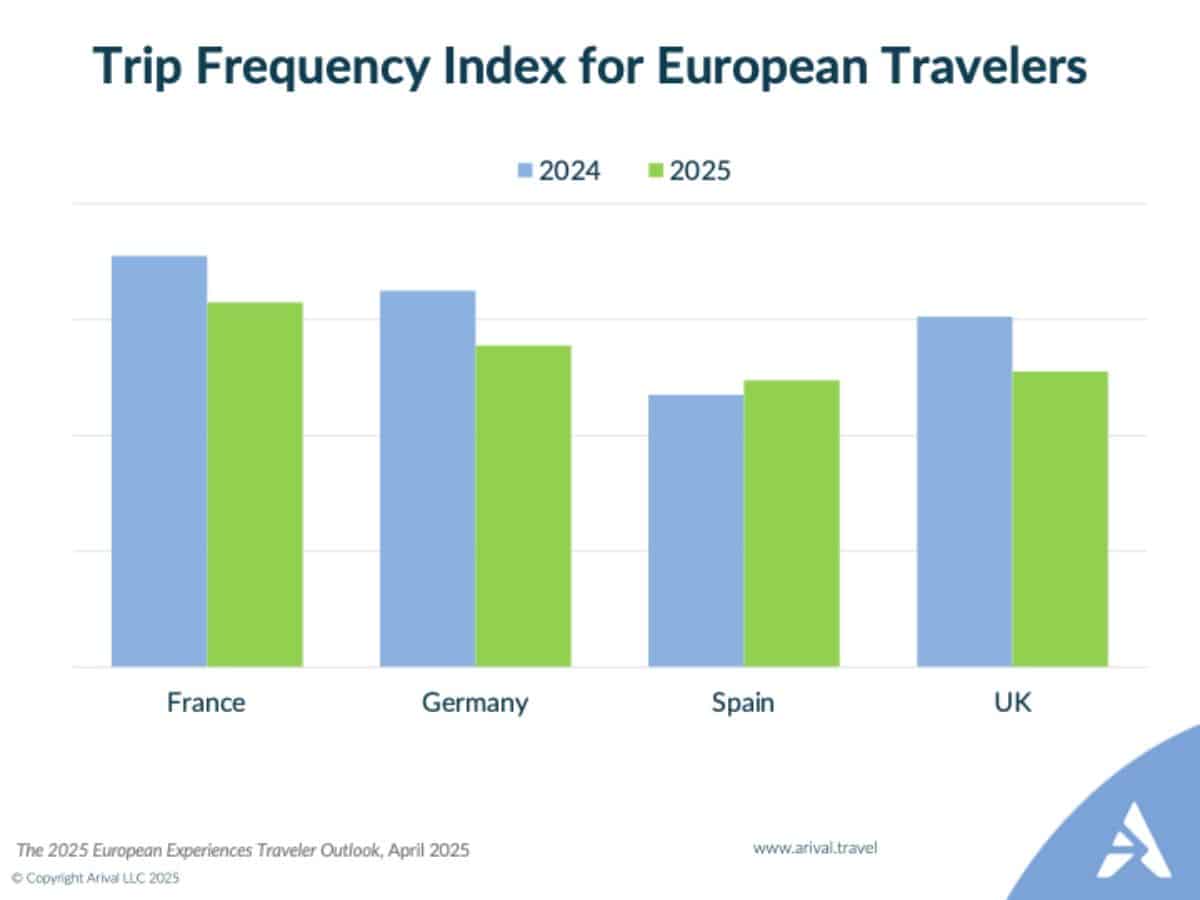

Fewer but Longer Trips for Most Traveler Segments

Looking at trip length and frequency among different traveler segments paints an interesting picture. Most European travelers took just three or fewer trips in 2024, but trips weren’t quick jaunts. On average, they were at least a week long, giving sufficient time for travelers to settle into vacation mode and experience a range of activities.

German and French travelers devoted the most time to travel. They were not only a more likely source of frequent travelers, but they also stayed the longest per trip.

Trip frequency differs by age group and income level as well — learn more in the full report.

Overall, a volatile macro environment is affecting global travel trends, and the majority of European travelers are planning to take fewer trips in 2025. Spain is the exception.

Operator Takeaway: Inflation, economic uncertainty and political instability are shaping the global economic climate, and travelers are entering the 2025 travel season with restrained enthusiasm. Operators and experience businesses should anticipate a challenging, competitive environment.

30 September – 3 October 2025

Insider Pro Access Members Save 20%

THE event of the year for solutions-focused In-Destination Experience creators and sellers

Get Your Last Call to Save Ticket Through 26 August!

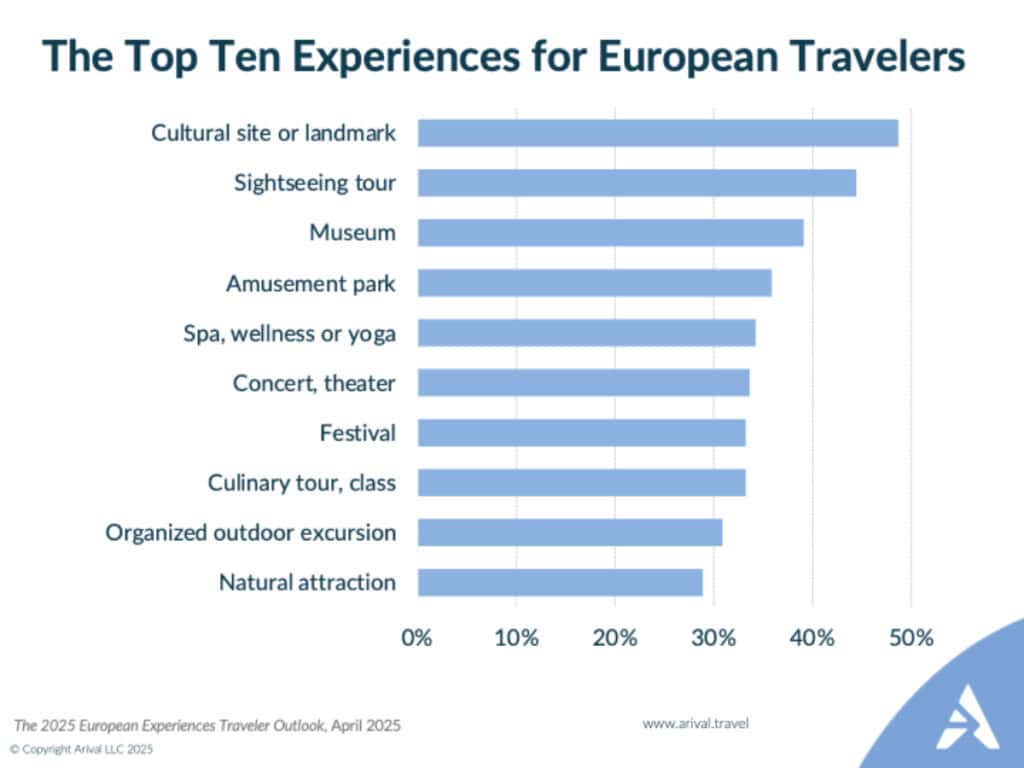

Culture, Sightseeing on Top, but Younger Travelers Want More

Europeans prioritize experiences rooted in history and culture. Cultural sites, tours and museums are the most popular categories. But there are profound differences in experiences preferences by traveler age and younger travelers are driving a more immersive, interactive future.

Older travelers seek out cultural experiences while younger travelers are especially attracted to more immersive, interactive experiences. Travelers 55 and older are much more likely to seek out sightseeing and museums, while younger travelers are driving demand for amusement parks, wellness and outdoor excursions.

Operator Takeaway: Tailor your offerings and messaging to the different traveler age segments for the most effective strategy. For example, market visually engaging content that showcases the immersive and interactive elements of your product offerings for younger travelers, and lean into culture for the older crowd. Learn more in the full report.

Dig Deeper with The 2025 European Experiences Traveler Outlook

The latest Arival consumer report delves into the state of the European experiences traveler – who they are, what they want, what are they looking for in 2025 – and some key trends shaping the tours, activities and attractions sector for the coming year. This outlook report, exclusively for Arival Insider Pro Access members, delves into the key trends, behaviors, sentiment and trip intentions of the European experiences traveler.

Learn More with Arival Research

The 2025 Experiences Traveler Research Series

This consumer research series delves into the wants, preferences, attitudes and buying habits of the U.S. experiences traveler. Based on a survey of 2400 travelers from across Europe and the U.S., this series of reports examine different aspects of the tours, activities and attractions traveler: who they are, what they book, why they book and what they want, how and when they book, what matters most to them, and much more. This is an essential research series for any creator or seller of in-destination experiences in the U.S. and Europe.

Find the full list of publications in this research series here:

Get the full Arival experience by joining us at an upcoming Arival event. Be the first to hear about the latest consumer and industry research insights, and stay up to date on the latest traveler trends in the experiences sector directly from tours, activities and attractions industry leaders and experts.

Become an Insider Pro Access member today and get access to the full library of Arival research, plus many other benefits such as free consulting sessions, special discounts and 20% off in-person events, starting from $179 per year.

Sign up to receive insights tailored for the in-destination industry as well as updates on Arival.