Whether they call it “yield management,” “revenue management,” or “dynamic pricing,” businesses like Disney, ski resorts, water parks, golf courses and more are embracing sophisticated pricing models to drive greater advanced sales and more revenue.

Since these terms can be interpreted several ways, I’d like to share how Liftopia defines them, as well as our philosophy on implementing pricing strategies across various types of ticketing businesses with a range of goals.

Different definitions of “dynamic pricing” represent tactics used in yield management across industries and types of businesses, from profit maximization for airlines, to systems utilization improvements like congestion pricing in cities.

According to my favorite citable reference, Wikipedia (who in turn, is citing Xotels), “yield management” is defined as “a specific, inventory-focused branch of revenue management, involves strategic control of inventory to sell the right product to the right customer at the right time for the right price.”

A simpler definition might be: “Using goals, data and tools to improve the efficiency of systems.” Yield management is another form of continuous improvement, in this case for pricing strategy.

Is Dynamic Pricing Right for Your Business?

Before I discuss the impact of pricing strategies on ticketing businesses (for example, parks and attractions, tours, activities and more), I want to clarify that my discussion is focused specifically on pre-sales of tickets given the trends of shifting from offline to online sales.

I am also making several assumptions:

- Your business sells some form of activity

- Attendance is not consistent day to day

- You want to sell more of your activity online, and generate more revenue overall

- You care about marketing efficiency and customer service

Before implementing a strategy, it is important to consider how your ticketing business compares to others. After all, a water park, an airline, a hotel, and a ski area are all different types of businesses that ultimately sell very different kinds of tickets or bookings.

Here are a few key questions to consider about your business:

- How likely is it that inventory will sell out? (A golf tee time, for example, is more likely to sell out than a day at a ski area.)

- How long is the consumption period? (A vacation rental is long while a go-kart session is short.)

- Is the product more like an activity or an event? (For instance, skiing is an activity; a soccer game is an event.)

The answer to these questions can help you determine what type of pricing strategy—variable vs. dynamic—makes sense for your business and whether you should focus on building long-term consumer behavior patterns or on narrow revenue maximization.

Inventory Constraints & Pricing Strategy

The likelihood that a business “sells out” can have a meaningful impact on two things:

1) How scientific a pricing strategy needs to be to drive consumer behavior.

2) The flavor of yield management that will drive the most substantial result.

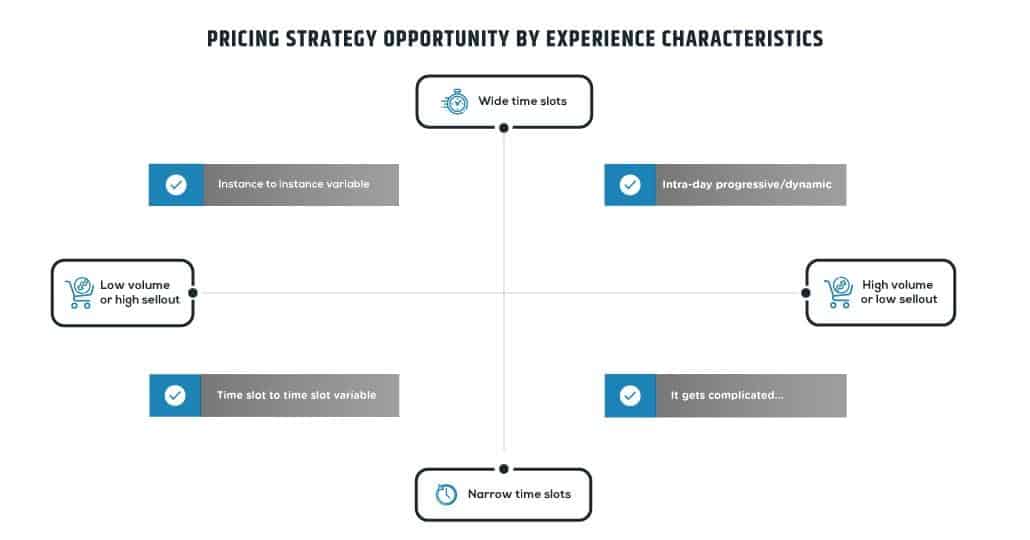

Different Pricing Strategies for Different Experiences

The characteristics of the experience your business offers can help determine which type of pricing strategy your business should focus on.

Typically, the more an inventory set is limited, the more likely a variable pricing strategy will yield the greatest revenue result.

With golf, for example, there is more of an opportunity to maximize the pricing of specific tee times versus others. The price of a golf game at 10 a.m. should be different than a game price at 4 p.m.; a golf game price should be different on Saturday than on Tuesday due to the limited availability of each tee time itself.

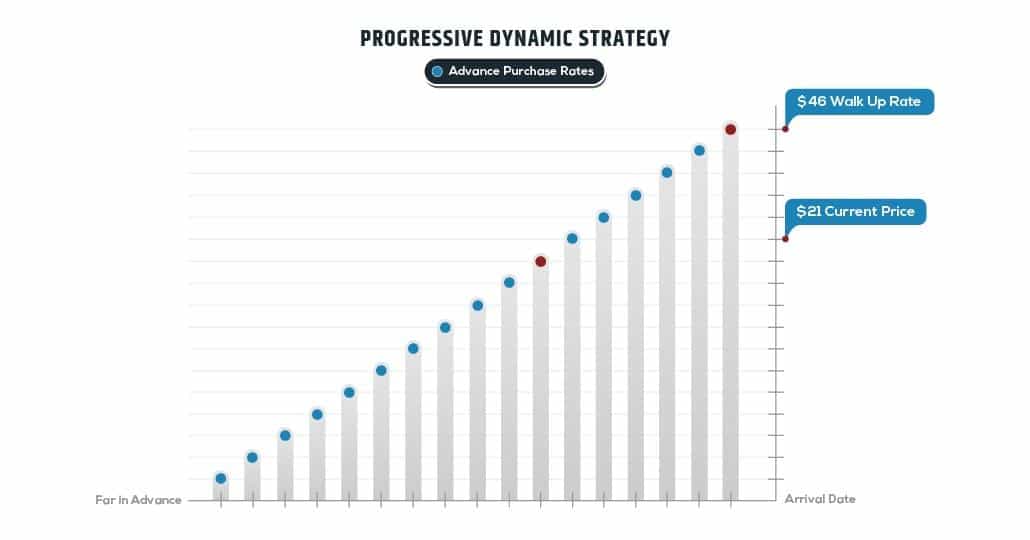

If your inventory isn’t likely to sell out, a more dynamic approach where prices move up over time is needed to drive the desired consumer behavior and revenue outcome.

A water park, for example, has a revenue opportunity to implement day-to-day price variability, and offer a range of prices that move up over time on each individual day.

Pricing Strategy: Events vs. Activities

There is also an important difference in pricing strategy if your product is an “event” as opposed to an “activity.” Events occur less frequently and are more distinct (e.g. a soccer game, where it matters who is playing), while an activity occurs more frequently with less variation as to when it occurs.

Whether your business sells “activities” or “events” can determine the level of risk in executing reactive pricing, such as last-minute price drops or surge pricing.

The more a product looks like an event, the more opportunity there is for narrow revenue maximization and the lower risk there is in deflating future consumer confidence. For example, the value of a ticket to a football game is heavily tied to the teams playing. “Reactive” pricing adjustments, either upwards or downwards, are unlikely to yield a negative impact on long-term consumer confidence.

The more your product looks like an activity, the more careful you have to be with reactive yield management, as your short-term profit may not be worth the erosion of future consumer confidence, impacting both customer service and conversion rates. In the long term, low levels of consumer confidence encourage shopping around for rates and lead to elevated marketing costs (because of lower conversion rates).

For example, when the hotel industry implemented frequent last-minute price drops due to low occupancy rates, customer reactions were positive in the short term, but decreased confidence in future buying. This created downward pricing spirals, compressed booking windows, and ultimately paved the way for companies like Sidestep, Kayak, and others to emerge as confidence boosters or last-minute channels.

The more your pricing yields higher consumer confidence, the higher your conversion rates will be (which will decrease your cost of marketing and is an investment in future buying behavior. This is especially important for activities and less important for events).

Key Takeaways for Operators of Tours, Activities, Attractions and Events

Now that we’ve looked at how different ticketing businesses might apply different types of revenue management, I’ll leave you with a few key pieces of advice for your own implementation:

- Don’t use feelings, use data.

- Consider whether actions are impacting long-term consumer confidence and therefore future marketing costs.

- The more third-party distribution you have where you don’t control sell rates, the less opportunity you have to yield manage.

- If you have a large secondary market (concert tickets, event tickets, sports tickets), it is more likely that yield management will benefit the reseller, but if you get better you can remove some of that margin loss.

- You can only do so much!

Want to learn more about revenue management from Liftopia’s Evan Reece? Register for Arival Berlin 2020, where he will be leading the specialized operator workshop, “Grow Your Profits with Dynamic Pricing & Revenue Management.”