As summer 2025 approaches, the travel landscape is marked by contrasts. In Europe , demand is softening slightly, influenced by economic uncertainty and shifting consumer habits. In the U.S., the slowdown – and uncertainty – is much more pronounced. Meanwhile, Asia is experiencing a continued surge, with post-pandemic “revenge travel” still approaching the peak in key outbound markets like China.

For experience operators in the tours, activities and attractions sector, this season isn’t just about attracting travelers—it’s about understanding which travelers are coming, what they’re looking for, and how to meet those expectations in real time. At Arival 360 | Valencia, Luis Millan, the Head of Market Intelligence for ForwardKeys, shared some insights on what we can expect this summer.

We’re sharing some highlights from Millan’s summer outlook session below, along with some practical takeaways for operators focused on the different regions highlighted. Arival Insider Pro Access members can watch the full session on-demand here, and join a special meetup in June to discuss the summer outlook.

Europe: Seeking Sun and Avoiding Crowds

For travel in Europe, sun and beach destinations lead demand, with the Mediterranean as a consistent favorite. At the same time, Millan shares, we’re seeing shifting interest from traditional hot spots like London and Barcelona to less-transited destinations as travelers aim to explore less notoriously crowded areas.

The shift away from more popular destinations is not just about avoiding crowds, but seeking more meaningful experiences. According to the latest Arival consumer research, 72% of U.S. and European travelers said it was “very important to go off the beaten path.”

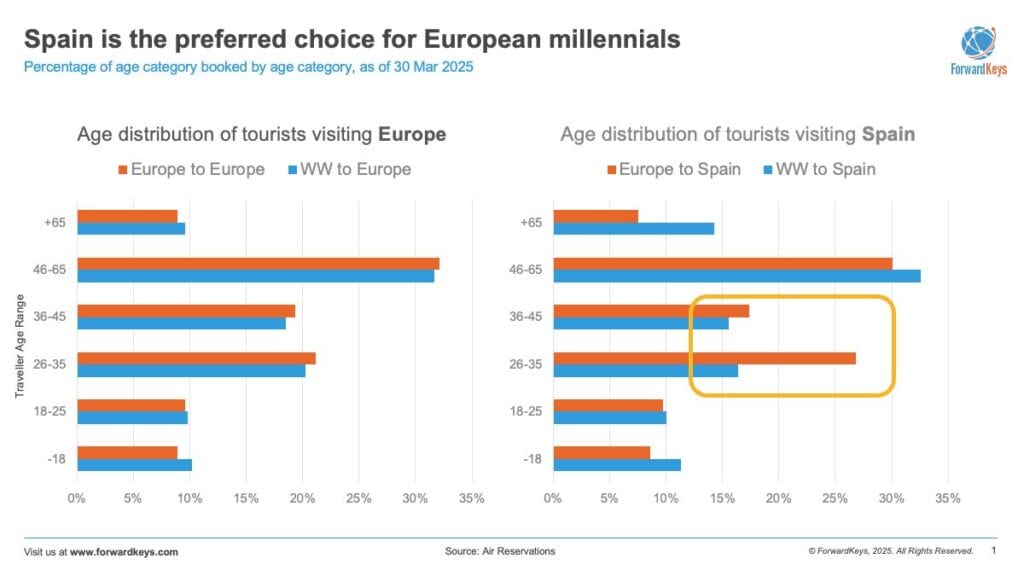

This sense of meaningful experiences is particularly important among younger traveler demographics, Millan says, highlighting differing interests and travel patterns among different age groups. “The activities and experiences that you are going to be proposing are going to be very different when targeting for baby boomers, millennials, or Gen Z.”

What this means for operators:

- Lean into secondary cities and emerging destinations: offer tours that highlight unique local stories away from tourist-heavy centers.

- Promote authenticity and exclusivity as key differentiators — particularly in cultural tours.

- Tailor products to millennials with flexible schedules, mobile-first booking, and Instagram-worthy experiences. Learn more about Instagram strategy here.

27-29 April 2026

Insider Pro Access Members Save 20%

THE event of the year for the European in-destination experiences industry

Get Your Super Early Bird Ticket Today!|

United States: Shifting Toward Shorter, Domestic Trips

In the U.S., uncertainty is shaping summer travel plans. Economic concerns, changing government policies, and the lingering impact of inflation are making travelers more cautious. Many are opting for shorter getaways, with road trips experiencing a resurgence in popularity, rather than splurging on international vacations. Booking windows have also shortened, with many travelers making decisions closer to their departure date.

Many U.S.-based operators say they are feeling the effects. The decline in international inbound travel, and the hesitancy among U.S. travelers to spend, is creating a softer environment and greater uncertainty in North America.

What this means for operators:

- Refocus marketing on domestic audiences — highlight “staycation” appeal, local natural and cultural attractions, and easy weekend escapes.

- Adapt offerings to fit tighter schedules — think half-day adventures, one-day excursions, or flexible timing.

- Invest in last-minute booking channels and ensure your Google Business profile and review presence are optimized. Learn more about marketing with Google here.

Asia: Rising Demand and Premium Preferences

While other regions are softening, Asia is experiencing an upswing in travel demand. Post-pandemic “revenge travel” is still building momentum, especially among Chinese travelers who are now traveling with a different mindset than before.

Smaller group sizes, more personalized itineraries, and a willingness to invest in premium experiences are key shifts. Travelers are seeking deeper cultural immersion and a higher level of service—moving beyond the large group tours of the past.

What this means for operators:

- Curate premium, small-group offerings that emphasize quality over quantity.

- Use personalization to stand out—incorporate local traditions, language options, and curated experiences.

- Pay attention to booking platforms and payment preferences used by Asian travelers—WeChat, Alipay, and Asia-based OTAs like Klook, Trip.com and Veltra. Learn more about Asia-based OTAs in this list of the top 20 OTAs in Asia Pacific.

Strategies for Summer 2025: Lean Into Flexibility, Authenticity, and Value

Across these regions, a few common threads stand out. Today’s travelers are looking for more than just a bucket list of sights: they want experiences that feel local, personal, and worth their time and money.

Flexibility is also a must. With uncertainty come shorter booking windows, price sensitivity and evolving travel plans, and so experiences that offer easy changes or cancellations have a clear edge. Affluent travelers in particular, while less price sensitive, are still selective in what they spend on, and are more likely to book VIP and premium products that offer a unique, authentic, more meaningful experience.

Here are a few actions tour and activity operators and attractions can take right now to position themselves for a successful summer:

- Audit your products for flexibility — can they be shortened, tiered, or bundled?

- Offer multiple price tiers (e.g., standard vs. VIP) to cater to a wider range of budgets.

- Highlight lesser-known destinations or times to help guests avoid crowds and get “off the beaten path.”

- Communicate what makes your tour different — focus on local guides, exclusive VIP access, or small group sizes.

- Refresh your visuals and descriptions to appeal to passion-driven travelers. Authenticity of experiences matter more now than ever.

- Lean into storytelling and UGC (user-generated content)—encourage reviews and photo sharing to build trust and social proof. Learn more about UGC here.

30 September – 3 October 2025

Insider Pro Access Members Save 20%

THE event of the year for solutions-focused In-Destination Experience creators and sellers

Get Your Spring Savings Ticket Today!

Looking Ahead: To Summer and Beyond

What happens this summer will influence how travelers approach fall and the rest of 2025. Operators who monitor patterns now — like average group size, trip duration, and customer feedback — can use that data to better anticipate demand in the shoulder season and beyond.

Ultimately, success this summer won’t just be about attracting volume: it’ll be about attracting the right guests with the right product at the right time. Those who stay informed, listen to their customers, and adapt to changing conditions will be best positioned for what comes next.

Dig deeper into the summer outlook at a special Arival Pro Meetup, hosted by Arival CEO Douglas Quinby, for an open Town Hall on what’s going on — and what operators can do about it. We’ll share the latest insights from Arival research and other industry sources, and you’ll have an opportunity to connect with fellow operators and industry leaders to discuss how to adapt —from product and pricing to marketing, operations, and more.

Stay Informed on the Travel Outlook and Trends With Arival

Learn more about the outlook for travel in Arival’s reports, including the 2025 U.S. Experiences Traveler Outlook and the 2025 European Experiences Traveler Outlook. Stay updated with the latest trends and insights by joining us at an upcoming Arival event.

Become an Insider Pro Access member today and get access to the full library of Arival research, plus many other benefits such as free consulting sessions, special discounts and 20% off in-person events, starting from $179 per year.

Sign up to receive insights tailored for the in-destination industry as well as updates on Arival.