Who doesn’t love free? You definitely can’t beat the price.

This was the pitch in the early days of software adoption in the tours and activities sector. In the mid-2010s, FareHarbor entered the booking software marketplace with a disruptive pricing model: we’ll provide you with a website and tack on a booking fee that the customer pays only when they book online. For all other bookings – offline, online travel agencies (OTAs) or other sources will be free.

Most booking systems relied on a more conventional SaaS (software-as-a-service) model of subscription (monthly fee), transactional (fee per booking), or some combination of both. There may also be additional costs for other features or components, such as a website or other services.

The new approach to pricing came at a pivotal time for the tours and activities sector. A majority of operators were still operating manually, without online booking capabilities or back-office booking systems. For many of the new booking system startups at the time – FareHarbor, Peek, Checkfront, Rezgo, Rezdy, Xola, and in Europe bookingkit, Regiondo, TreffSoft and several others – they were not just trying to get operators to change to their systems. They are trying to convince operators to USE a booking system.

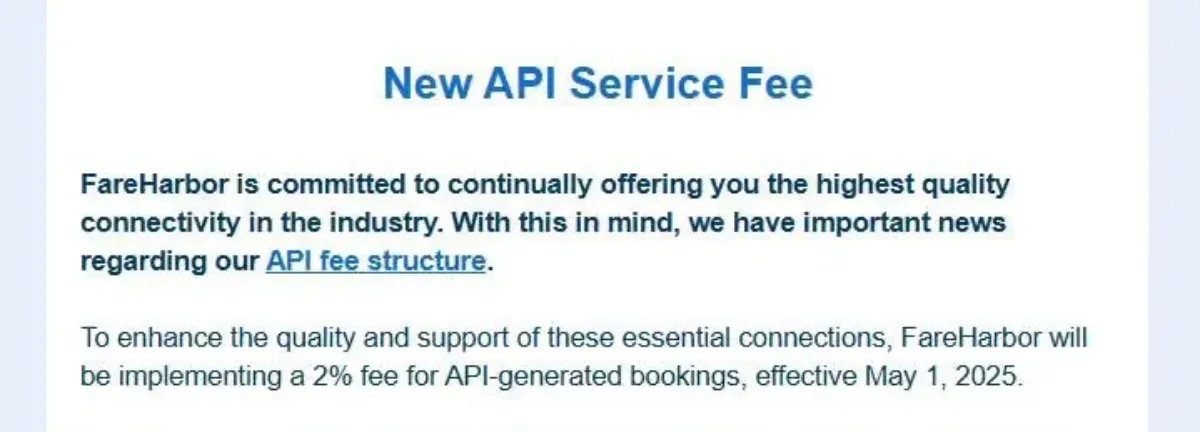

Fast forward to today, where for many operators who are long-time FareHarbor clients, the company’s introduction of a 2% API fee for third-party bookings has been more than a tough pill to swallow.

“People are furious, absolutely livid,” one U.S.-based tour operator shared with Arival. By adding the API fee, some feel they are backtracking on a key selling point they used to win over so many customers.

Many operators have reached out to Arival directly to express their concerns, ranging from the increased pressure on tour pricing amid a software market in 2025, and to the question of value to the timing of the fee — which came in just before peak season for many. The subject was a hot topic at Arival 360 | Valencia, where FareHarbor CEO Andrea Carini took to the stage.

So what’s the deal with API fees? How are operators responding to the new API fees? And what does this mean for operators and the booking system landscape in general?

FareHarbor Joins Growing List of Companies Charging API Fees

FareHarbor’s 2% API fee has been gradually introduced by region, starting sometime in early 2023 for operators in Europe, and was rolled out in the U.S. earlier this year. The fee, which is applied to the gross total of each booking processed via API through Fareharbor’s booking system, includes bookings such as those coming through online travel agencies (OTAs) and other third parties.

But API booking fees are nothing new — many booking system providers have been charging them already as part of their pricing structure:

- Bokun charges 1.5% for API/OTA bookings on top of their monthly subscription fee, but does not charge for bookings through Viator. (Bokun and Viator are both subsidiaries of Tripadvisor.)

- Rezgo charges a 0.9% fee for POS (which includes API) bookings.

- Tripworks charges a 2% fee for bookings that come through OTAs.

- Some platforms, including Peek, TicketingHub and XOLA, do not charge an API fee at present.

- Other platforms, including Bookingkit, Rezdy and Ventrata, operate on monthly subscription fee models, and may or may not charge additional fees for API bookings depending on your plan.

- Learn more about booking system pricing and compare pricing structures here.

So why are more and more res-tech companies charging API fees?

What is an API?

API stands for Application Programming Interface. Essentially, it’s the way different software systems speak to each other. An API is a mechanism that allows the technology systems of the supplier and reseller to communicate, sending information back and forth on inventory and pricing, bookings, customers, and more. Most reservation systems today offer APIs into the major online resellers. Learn more in the Arival Glossary of Terms: Travel Distribution & Technology.

With the Rise of OTA Bookings… Come API Fees

The cost involved with supporting API connections is one frequently cited reason for why booking systems charge — or are beginning to charge — API fees.

One booking system provider who asked to remain anonymous explains the reasoning behind API fees from the restech perspective: “There’s actually huge engineering costs, those APIs change all the time, and it requires very expensive resources. It’s a pretty significant lift to actually do it.”

However, the biggest reason for the general shift among restechs towards charging API fees likely has to do with the increased share of bookings OTAs are attracting. OTAs have been the fastest-growing sales channel for several years now, which means booking systems that structure their pricing around a percentage of direct booking revenue only are supporting more booking volume without a comparable share of revenue from those bookings.

“We have operators that have maybe 70, 80% of their bookings coming from OTAs,” shared FareHarbor CEO Andrea Carini during an interview at Arival 360 | Valencia. “So how do we, if we continue with an online booking fee only, how can we serve clients that want to be predominantly on OTAs?”

Carini’s sentiment about OTAs is echoed by other booking system providers. “Operators are selling more and more through OTAs and we’re the ones providing the service and the connectivity,” explained another booking system provider, who does not currently charge for API bookings but is considering adding a fee in the future.

Booking System (Dis)Satisfaction: Operators Looking for Change

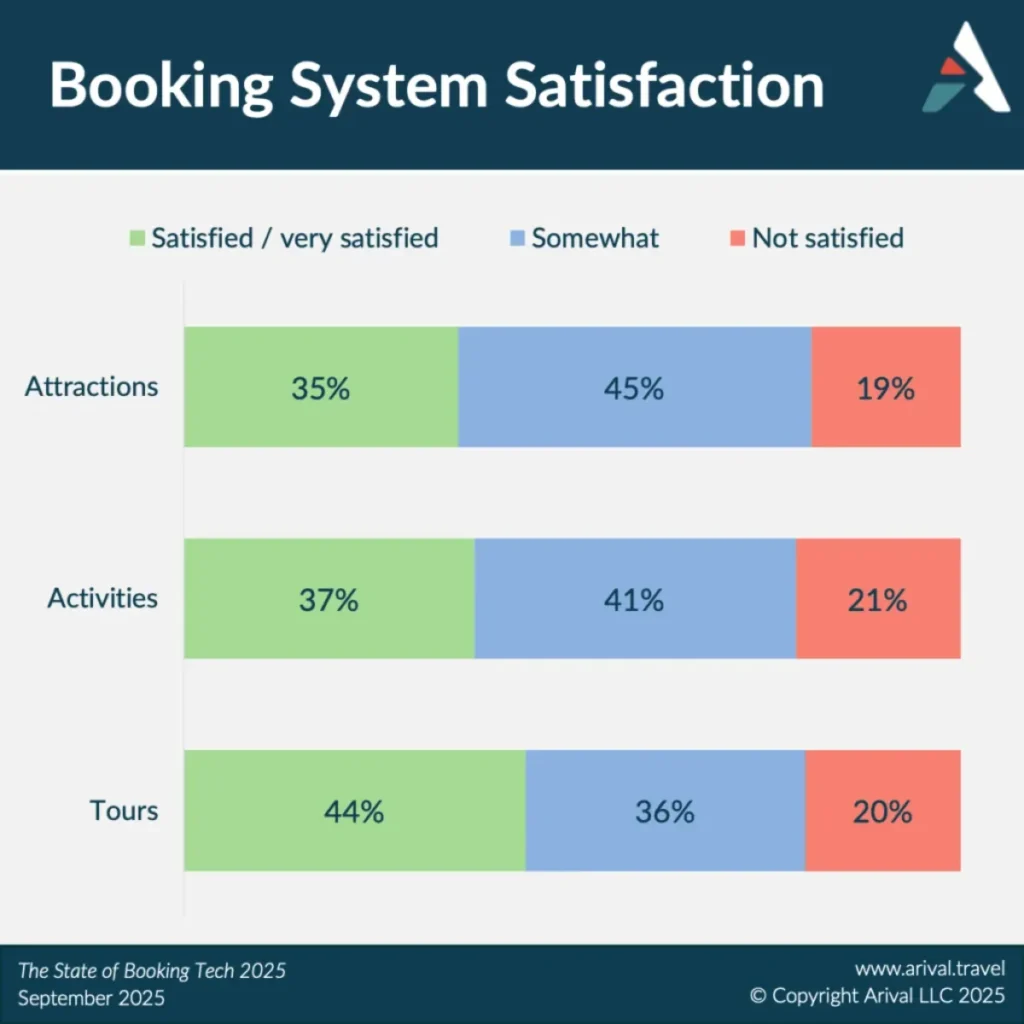

Arival research shows many operators are looking for a change — and it goes beyond FareHarbor.

Among operators surveyed for Arival’s Global Operator Landscape (3rd. Ed.) study, less than half of the 7,000 tour operators and attractions surveyed said they were satisfied or very satisfied with their booking system provider. One in five operators across all categories and sizes said changing their tech is a top priority for their business.

For some operators, the added API fee is simply another incentive to re-think what they want from a booking system.

“I see the tides changing, I see this as an opportunity for operators to evaluate their restech on the benefits of what it’s doing for them to grow their business and to sustain it,” one operator shared. “Look at other restechs and choose the one that’s the best fit for you and your business.”

13-16 Oct 2026

Insider Pro Access Members Save 20%

THE event of the year for creators and sellers of destination experiences to connect, learn & grow.

Get your Early Bird Ticket Today!

What’s Next for Booking Tech: Beyond the Basics

Another tech executive, when asked if they thought FareHarbor’s new fees would be an opportunity for other booking systems to win over upset operators with lower or no API fees, said it could happen in the short term.

“But, I think they are actually just catching up to the rest of the market,” they added, asking not to be named in the article. “The future is about adding new features and value, and good operators understand there will be a cost.”

Booking system adoption has grown dramatically over the past decade, and now almost all established medium-sized and large operators now use an online booking system. The core functions of an online booking system — managing availability, processing payments, handling bookings — have largely become standard. Today, dozens of systems offer these capabilities.

The real differentiation for booking platforms will come from value-added services that directly drive revenue and improve efficiency. We’re already seeing early signs: integrated marketing tools that connect operators to new audiences, conversion optimization features that test and refine how tours are presented, and new pricing capabilities that adapt rates in real time to demand and inventory. The rise of AI will only accelerate this shift.

There are signs that more change is coming to the industry. With the recent appointment of FareHarbor founder and former CEO Lawrence Hester to lead the Rezdy-Checkfront-Regiondo combination of booking system companies, for example, we’re watching closely to see what that company — which is now the second largest in the industry — will do next, and what it will mean for operators.

Learn More About Booking Tech With Arival!

Arival’s latest report, based on a survey of 7000 operators worldwide, explores The State of Booking Tech. Check out also the Arival Guide: How to Choose a Booking System as well as our recently-updated Arival Guide to Booking System Pricing if you’re on the lookout for a new booking system provider.

Also, join us at an upcoming Arival event to learn more about the continued evolution of the booking system landscape and connect in-person with representatives from the many booking system providers that will be in attendance.

Become an Insider Pro Access member today and get access to the full library of Arival research, plus many other benefits such as free consulting sessions, special discounts and 20% off in-person events, starting from $179 per year.

Sign up to receive insights tailored for the in-destination industry as well as updates on Arival.

Header photo: AI Image Generation by Horiar AI