Consolidation and brand-building are major, recurring themes in all industries, and certainly across travel. Why not in tours and experiences?

Market conditions warrant it. The sector is extremely fragmented. There are hundreds of thousands of tour operators and experience providers, but they are mostly small businesses. Barring a few multi-city hop-on/hop-off bus brands (City Sightseeing, Big Bus) and the Gray Line licensing model, there are virtually no globally recognized brands.

A Long Tail of Small Operators

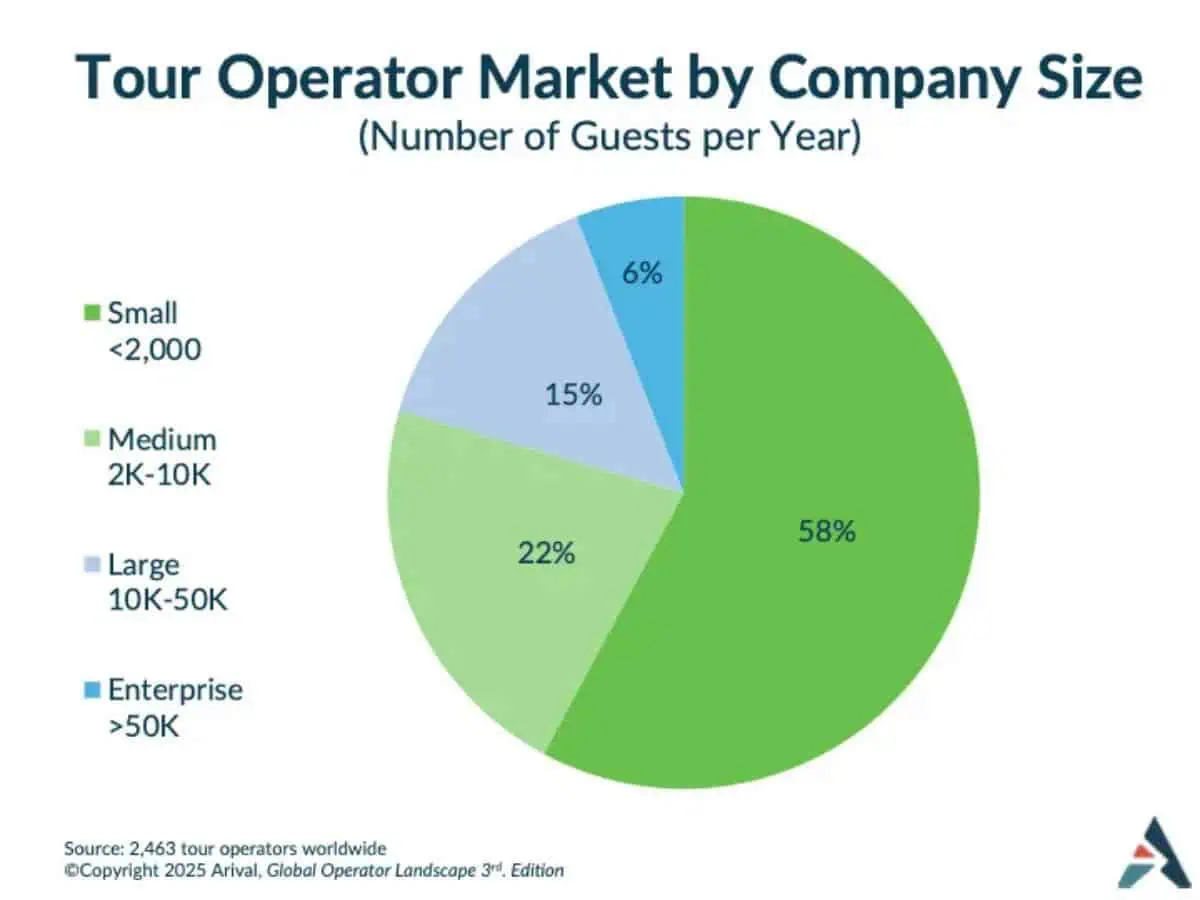

In Arival’s Global Operator Landscape 3rd Ed., a survey of 7,000 experience operators worldwide, the vast majority of tour operators are small or medium-sized operations (based on our groupings by average number of guests served in the past year).

The tours sector is large, but largely unorganized. There are no universal service-level standards, no hotel-style star ratings, and no standard operating procedures. A single search for the Colosseum can yield over a thousand listings across OTAs like Viator and GetYourGuide.

Such fragmentation creates friction for consumers, and plenty of market inefficiencies. There is no shortage of lessons from other industries dominated by small businesses: coffee shops (Starbucks), fitness and wellness (PlanetFitness, CrossFit, MassageEnvy), family entertainment centers, and so on.

What’s Holding the Sector Back?

So why hasn’t more consolidation happened, especially given the growing industry enthusiasm for tours and activities. It’s a fast-growing sector in tourism, and travelers are increasingly planning travel around experiences.

Despite the excitement over the rise of experiences, there are long-held assumptions which have been effective investor deterrents:

- A Long Tail of small businesses means investors have to do a lot of deals to achieve scale.

- Many operators are low-tech, lifestyle businesses (three in four, according to our research), which means a heavy operational lift to modernize and integrate with other operators.

- Barriers to entry are low, especially in asset-light tour businesses such as walking and food tours.

Yet despite these barriers, the past decade has seen a subset of operators modernize operations, adopt tech, and thrive — setting the stage for the consolidation ahead.

Tours Have Come a Long Way

Much of the tours and activities sector is far behind the rest of travel in technology and business modernization. However, there is a significant subset of technology-forward operators that are leading the industry into the future.

1. There Is Scale at the Top

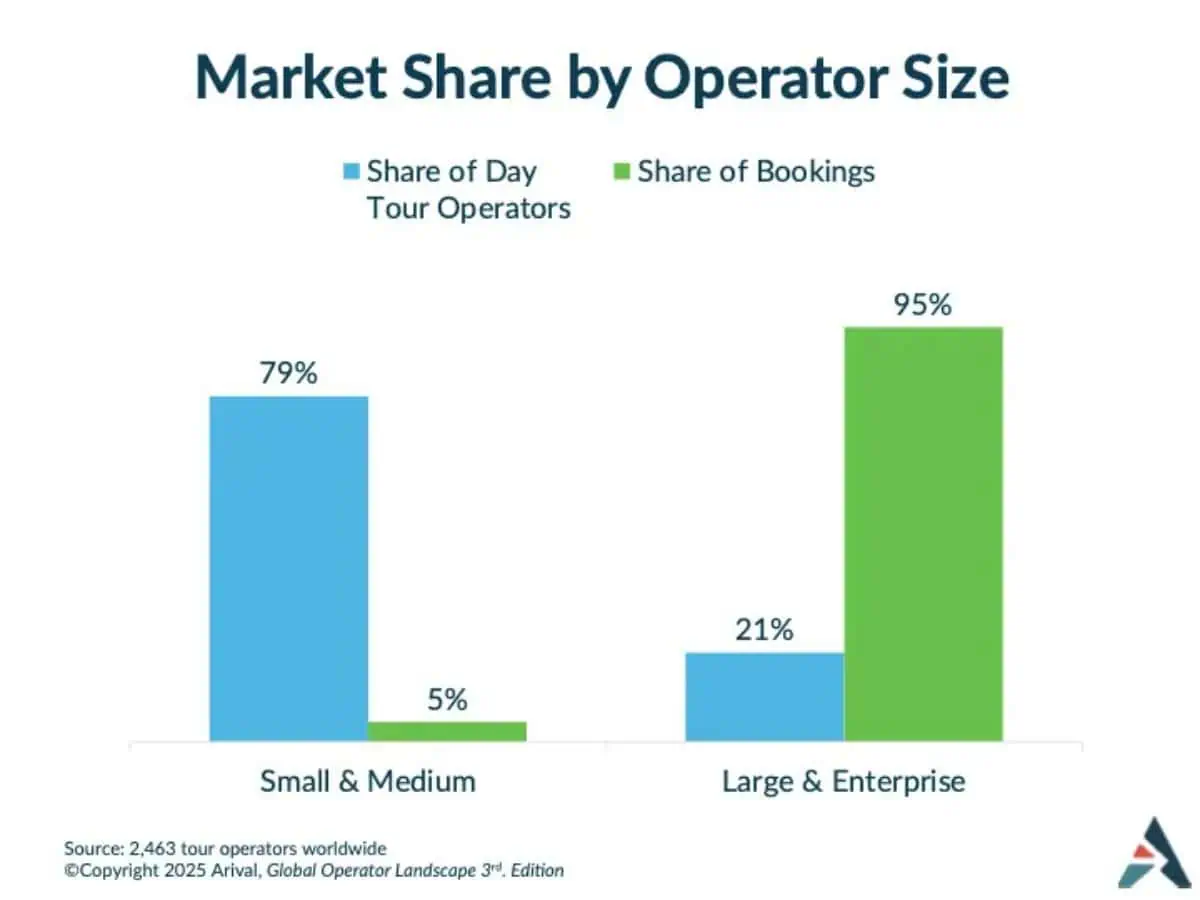

That smaller cohort of larger operators – those handling at least 10,000 guests per year (PAX), which represent 21% of all operators, per the chart above – account for the vast majority of sector revenue. Our modeling suggests they may account for as much as 95% of all bookings.

2. The Operators that Matter Are Connected

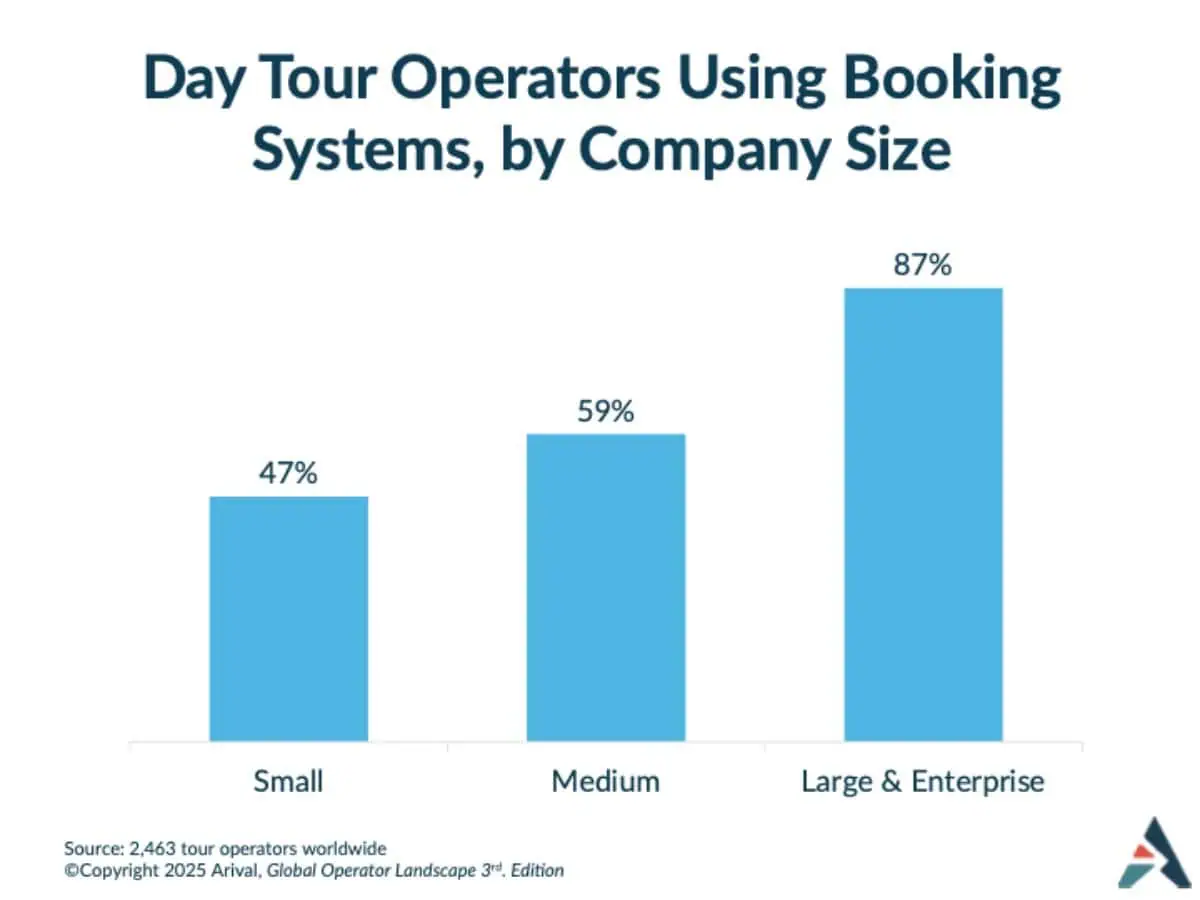

While the tours and activities sector is well known for its slow pace of technology adoption – two in five operators still do not modern online booking software to operate their business – the operators that move the market are ahead in tech.

The vast majority of larger operators use booking systems, connect to OTAs via APIs, and use a variety of platforms to run their business. Many operators are looking to implement capabilities such as dynamic pricing.

3. Balance Sheets Are Healthy Again

There were probably few industries more brutalized by the pandemic than the tours sector. Following more than two years of virtually no international tourism (upon which the tours sector is particularly reliant), the sector is booming, especially in Europe.

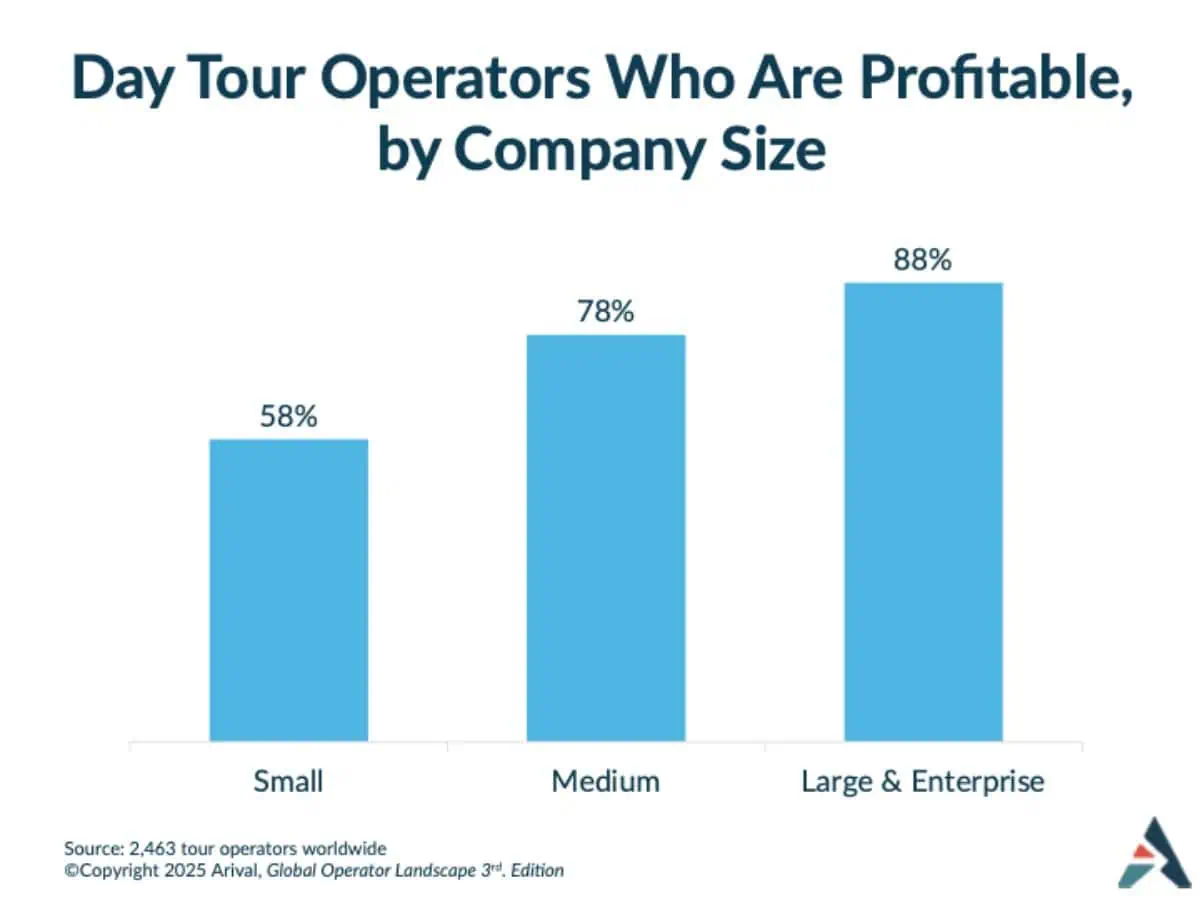

Balance sheets are healthy, business is solid, and larger operators in particular appear to be more profitable. Nearly nine in 10 reported profitability last year (vs. an industry average of 65%), and they also report higher rates of profitability.

4. Operational Excellence Is a Must in the Era of Experiences

The tours sector has low barriers to entry. In other words, it’s famous – or infamous – for the ease with which new entrants can enter a market, offer cheap tours and start a race to the bottom. The sector has no shortage of fly-by-night operators of dubious quality and – in some cases – business ethics.

But the market is changing rapidly. More and more, travelers are prioritizing tours and experiences in their travel planning. They are booking further in advance, and they expect pristine digital experiences and operational excellence.

Online reviews make – or break – new tours and experiences. For many operators, the quality of their tour listings and the volume of four- and five-star reviews across OTAs and other websites are key assets.

Today’s operators must have operating excellence across marketing, tour delivery and resource management. Those that don’t will be outmaneuvered by those that do, from winning customers and retaining guides to ensuring profitability across all tour departures.

What Makes a Target for Acquisition?

Not every operator would be a candidate. Indeed, most would not. Here is a profile I’ve assembled based on conversations with a range of industry executives.

- Profitable and growing: High single-digit to low double-digit growth.

- Technology-forward: Using modern booking systems, automation, and connected distribution.

- Strong assets: Direct booking strength, high-performing OTA listings, or dominant positioning in key destinations.

- Local leverage: Established relationships with visitor attractions, DMOs, and other key partners in the local market.

- Operational excellence: Skilled guide networks, scalable operations, and consistent product quality.

One last “soft” quality will be essential: flexible owners and management. For a roll-up to work, economies of scale will be critical. The business owners and managers who stay with the business will have to be open to operational and cultural change, often a hard pill to swallow for owner-operators who’ve built a business with their own two hands.

This recent article from Oliver Mernick-Levene, the CEO of Secret Food Tours, provides a detailed walk-through of a recent acquisition, and covers what operators should expect during the process, and after.

What This Means for Operators, and the Industry

A scaled, strategic roll-up of operators across key markets could achieve economies of scale across operations, marketing and distribution that could significantly change the landscape for travelers, operators and resellers.

- Opportunities for the right operators: Brands with high-quality products, scalable operations, and defensible assets may be prime acquisition targets, gaining access to capital, operational support, and broader distribution.

- Risks for smaller operators: Those without differentiation may struggle to compete as consolidation concentrates power among more efficient, technology-forward brands.

- A new negotiating landscape with OTAs: A scaled operator could have new negotiating leverage with the large resellers.

Looking Ahead: Will This Really Happen?

Fragmentation, uneven quality, and renewed financial strength among leading operators create a strong case for consolidation. The current level of fragmentation and experience inconsistency is simply not a good thing for consumers. That’s why I expect, over the next few years, to see strategic, long-term investors acquire well-run operators, scale operations and transform the landscape.

This article was originally published on Phocuswire.

27-29 April 2026

Insider Pro Access Members Save 20%

THE event of the year for the European in-destination experiences industry

Get Your Holiday Season Ticket through 27 January!

What’s Next for Experiences

Keep up with the latest on the ever-evolving experiences industry landscape with Arival. Join us at the next Arival event to stay up to date on the latest developments in the experiences sector directly from tours, activities and attractions industry leaders and experts.

Become an Insider Pro Access member today and get access to the full library of Arival research, plus many other benefits such as free consulting sessions, special discounts and 20% off in-person events, starting from $179 per year.

Sign up to receive insights tailored for the in-destination industry as well as updates on Arival.

Header Photo: Pexels / Ahmet Kurt