LGBTQ+ travelers do more experiences and spend more on those experiences than other (non-LGBTQ+) travelers, the latest Arival research has found.

The LGBTQ+ travel market worldwide is significant. The World Travel & Tourism Council (WTTC) and International Gay & Lesbian Travel Association (IGLTA) estimate it at well over $200 billion a year. In the U.S. alone, it accounts for more than $65 billion.

Experience operators are well positioned to benefit from these more affluent, higher-spending travelers. To help experience providers tap into this market, we delved into who these travelers are, what experiences are most interesting to them, how they are spending their time and money on these experiences, and how tour, activity, attraction and experience operators can design or adapt their offerings to better serve this segment.

Who are LGBTQ+ Travelers?

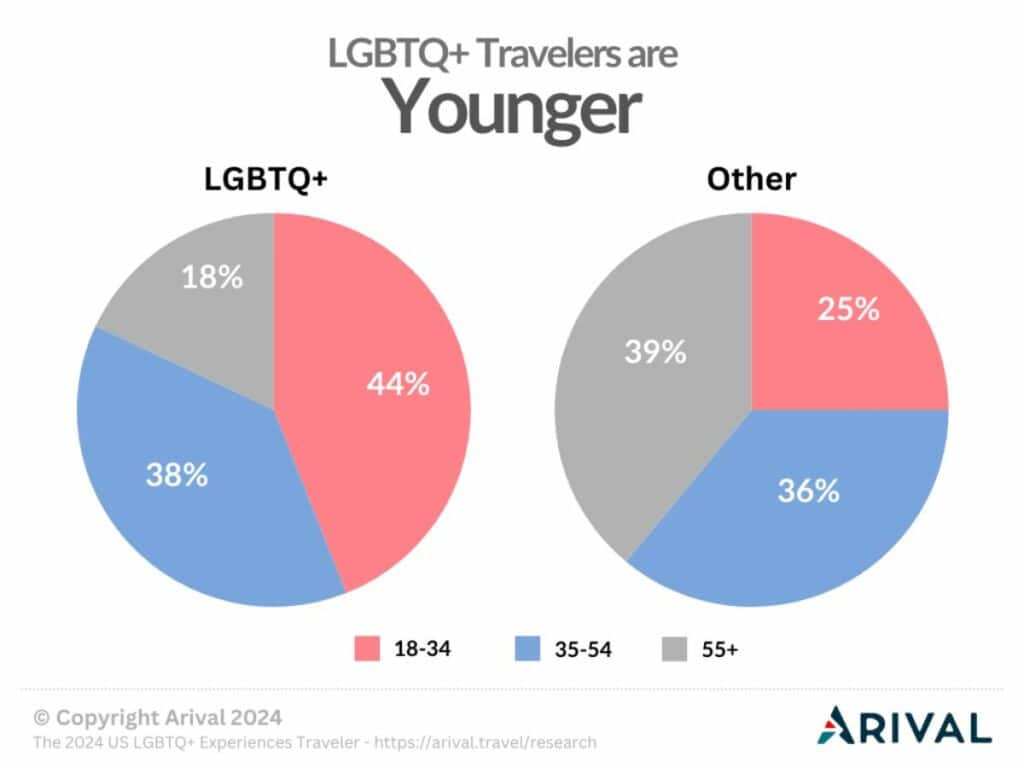

LGBTQ+ travelers are young.

Travelers who identify as LGBTQ+ (Lesbian, Gay, Bisexual, Transgender, Queer, and others who identify as part of the larger community) are much younger on average than other (non-LGBTQ+) travelers. In fact, 82% of LGBTQ+ travelers are between 18-54 compared to 60% for other travelers. The majority of these travelers are between the ages of 18 and 34.

Why such a young cohort? According to the Trevor Project, a leading non-profit organization focused on crisis intervention and suicide prevention for LGBTQ+ youth, more young people are identifying as LGBTQ+ at a younger age. In general, U.S. society has become more accepting of LGBTQ+ people over the last 30 years, making travel safer for openly LGBTQ+ travelers. In addition, according to the HRC’s (Human Rights Campaign) most recent Corporate Equality Index, 91% of Fortune 500 businesses include “sexual orientation” and “gender identity” in their nondiscrimination policies. This means that more people who identify as LGBTQ+ are finding and retaining work without the fear of being discriminated against. This employment stability in combination with greater societal acceptance provides them with the income and flexibility to travel.

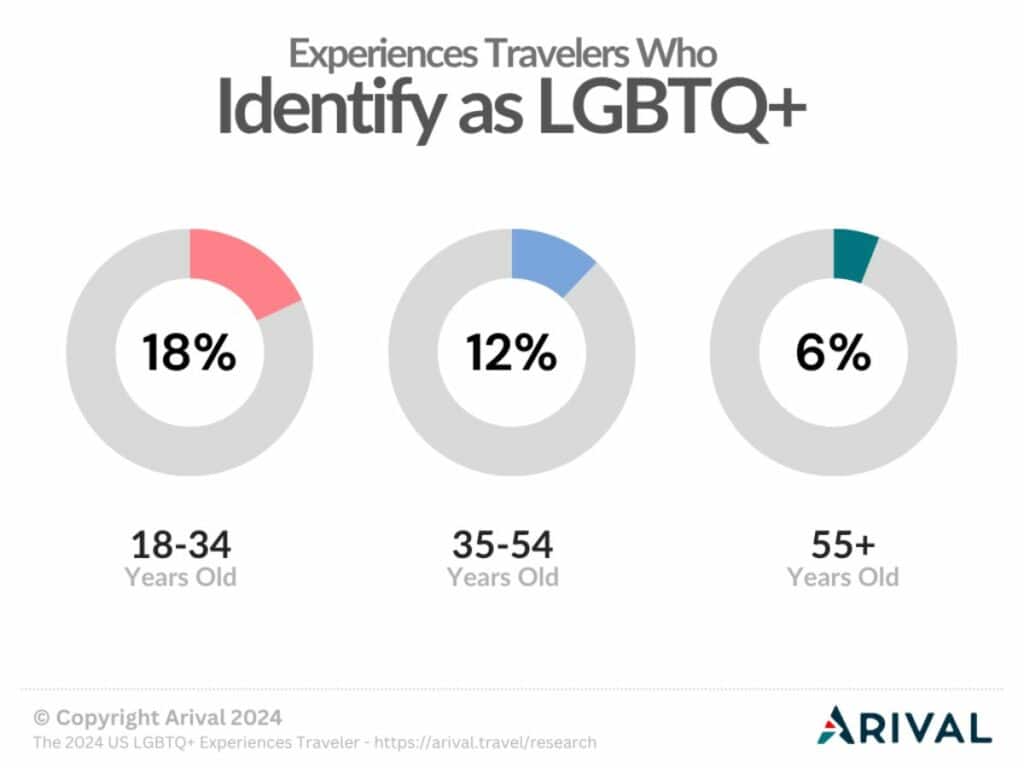

There is also a significant drop in the number of older travelers who identify as LGBTQ+. Nearly one in five (18%) of those surveyed between the age of 18 and 34 identified as LGBTQ+, compared to just one in 20 (6%) of those over 55. Because LGBTQ+ travelers tend to be much younger, they share a lot of similarities with younger travelers in general.

Why the age discrepancy? Or, why are so many younger travelers identifying as LGBTQ+?

A key factor is likely a combination of a more accepting and open society and the fact that, according to the CDC, the peak of the AIDS crisis from 1981-2000 resulted in the deaths of almost 450,000 people in the U.S. alone. Most of the victims of that crisis would now be in that older age group. In addition to the impact on the total population, openly LGBTQ+ people in the 1980s-2000s would have faced discrimination in the workplace having few if any anti-discrimination protections. Even now, according to the EEOC (Equal Employment and Opportunity Commission), only 22 states and the District of Columbia have laws explicitly prohibiting workplace discrimination based on gender identity and sexual orientation. As a result, their financial ability to travel would likely be limited now in their older age.

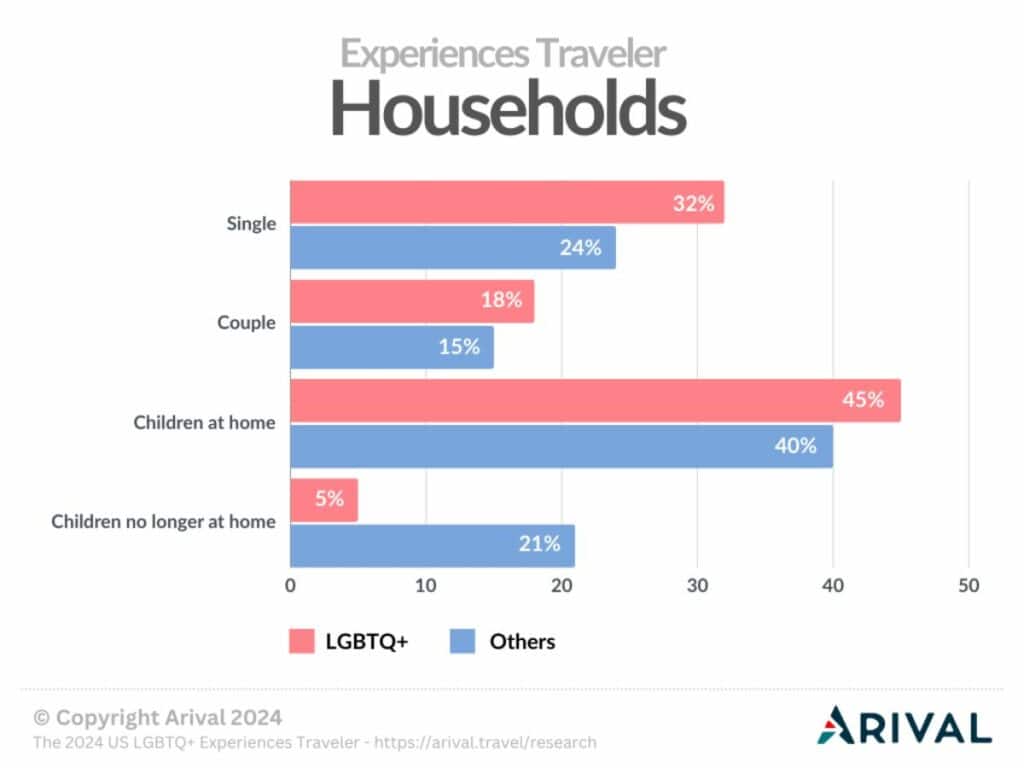

Many LGBTQ+ travelers also travel with children.

Although one might expect that LGBTQ+ households would be predominantly single or couples, 45% of LGBTQ+ travelers surveyed reported their households include children. These households are traveling with their children at a similar rate to other (non-LGBTQ+) travelers with children.

We can expect that this cohort of travelers will likely increase as more LGBTQ+ families look to have more children while still prioritizing travel.

Operator takeaway? For operators, inclusive marketing and experience design is relevant for singles, couples and all types of families. For example, consider including a picture with same-sex parents among your family pictures.

What LGBTQ+ Travelers Do — and How Much They Spend

“The Pink Dollar”: LGBTQ+ travelers are more affluent and spend more than their non-LGBTQ+ counterparts

When it comes to household income, we found that LGBTQ+ travelers are more likely to be affluent ($150,000+) when compared to other (non-LGBTQ+) travelers.

LGBTQ+ travelers, affluent or not, do spend more than their counterparts, specifically when it comes to experiences.

LGBTQ+ travelers do more experiences per trip than their counterparts

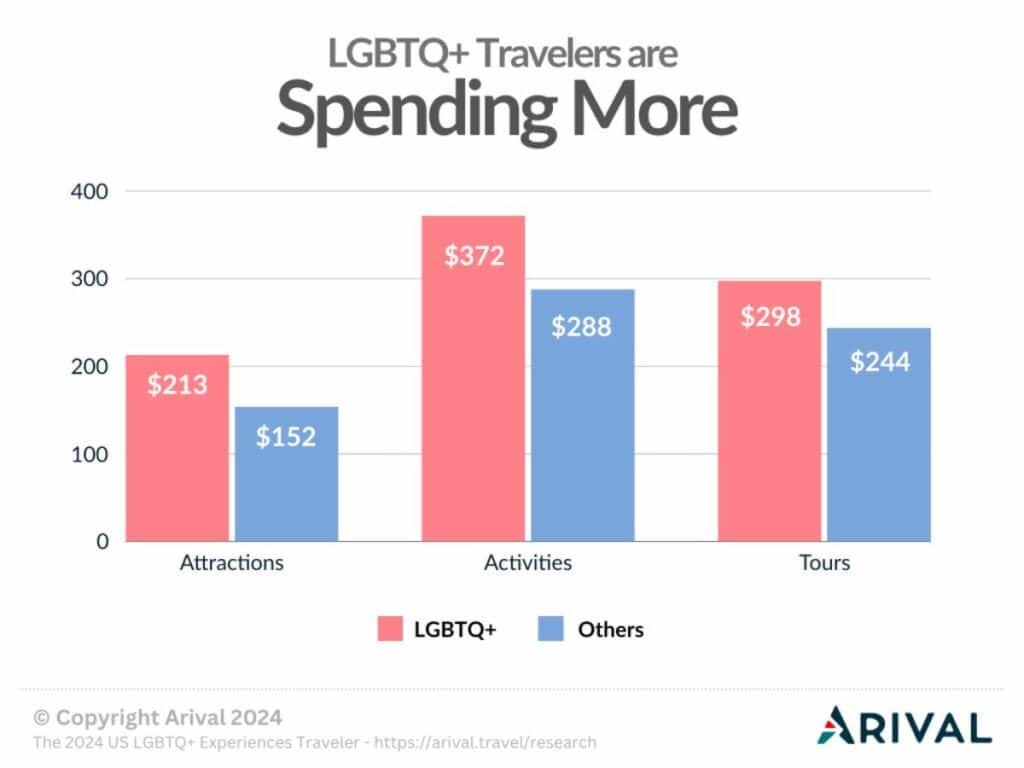

LGBTQ+ travelers do more experiences on their trips and then spend more on these experiences in general. For example, with attractions, LGBTQ+ travelers visited two more attractions on average at a spend of $60 more per attraction.

LGBTQ+ travelers were also more likely to partake in outdoor adventures and activities. In fact, 73% of LGBTQ+ travelers stated that they had done an activity on their last trip versus only 56% of other travelers. As we reported in the Arival 2024 Outdoor Adventure & Activities Traveler report, an average of 58% of travelers overall did activities, which indicates that LGBTQ+ travelers are an ideal target market for activity operators. As with the attractions, LGBTQ+ travelers are doing two more activities per trip with an average 23% increase in spend per activity.

Tours are also very popular with the LGBTQ+ travel community. Three in four LGBTQ+ travelers indicated that they had done a tour, 10% more than other travelers. And, they did almost double the number of tours of their trips as other travelers, averaging a significant four tours per trip compared to only two for other travelers. Although the difference in spend (+18%) is not as high as other categories, the overall spend when the number of tours is taken into account indicates a willingness to spend on tours in a big way.

Where LGBTQ+ Travelers Go

The “Disney Gays” — Amusement parks & the LGBTQ+ traveler

You may or may not be aware of the phenomenon that is the “Disney Gays”, a cohort of the LGBTQ+ community that is seemingly obsessed with all things Disney and can be seen centering major life events like birthdays, anniversaries, and wedding proposals around visits to Disney attractions.

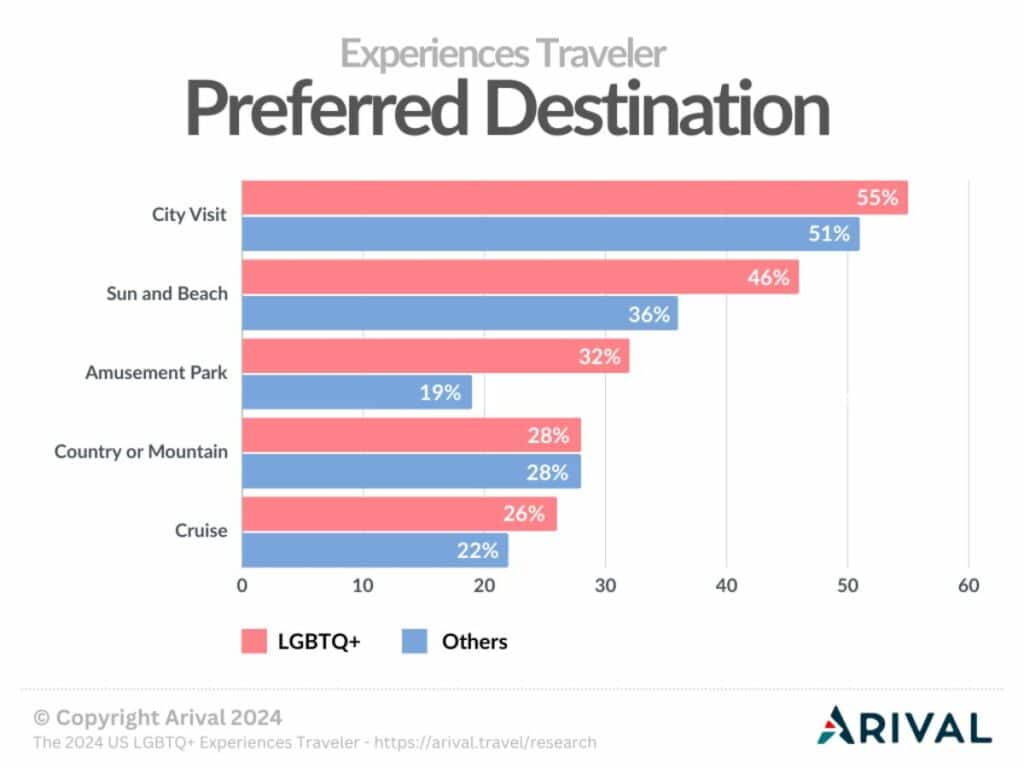

It turns out that LGBTQ+ travelers, more specifically gay males, are much more likely to visit amusement parks than other travelers. In fact 32% of LGBTQ+ travelers said they had visited an amusement park versus only 19% of other travelers. Of that group, the vast majority are male (three in 10) versus female (one in 10). For those that travel domestically, this also coincides with the top destination choices of Florida and California, both locations of Disney, Universal, and other major theme parks.

City lights & beach vibes — Top LGBTQ+ traveler destinations

Another area of distinction between LGBTQ+ travelers and others is their preference for both cities and beaches. City visits ranked very highly, there is a definite preference for beach trips. 46% of LGBTQ+ travelers said they visited a sun and beach destination compared to 36% of other travelers. As with the affinity for amusement parks, this preference for sun and beach also coincides with preferred destinations like Florida and California, which ranked among the top three destinations along with New York.

13-16 Oct 2026

Insider Pro Access Members Save 20%

THE event of the year for creators and sellers of destination experiences to connect, learn & grow.

Get your Early Bird Ticket Today!

LGBTQ+ Traveler Priorities

LGBTQ+ travelers prioritize inclusion & representation.

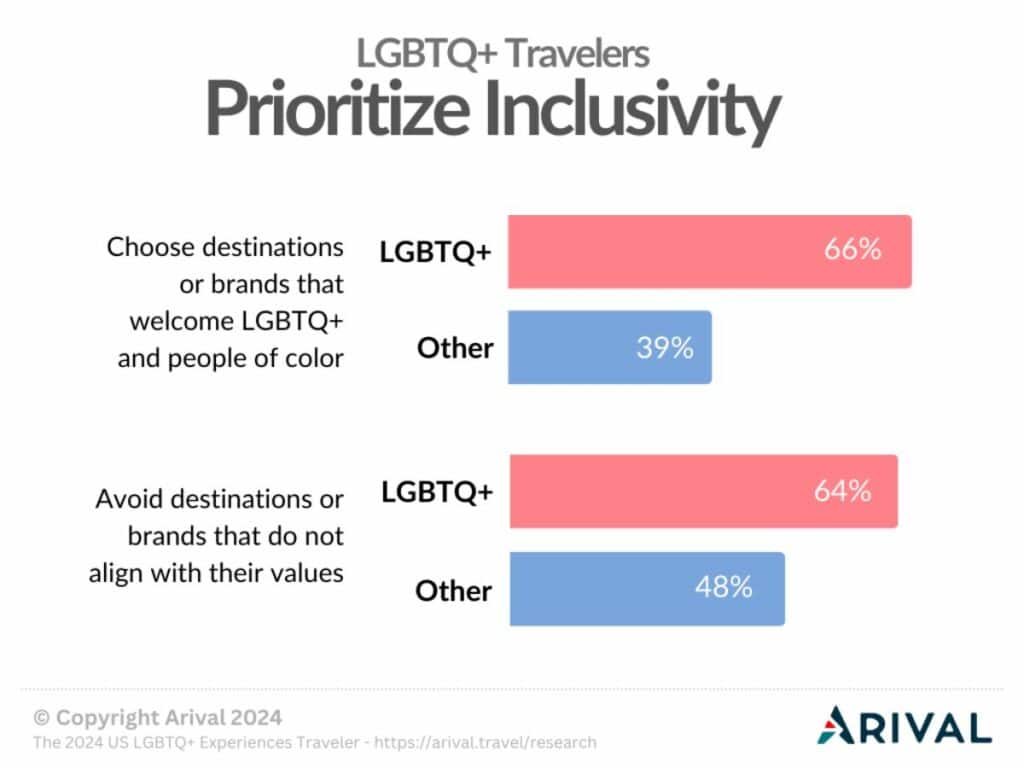

For LGBTQ+ travelers, whether destinations and businesses are welcoming to LGBTQ+ and people of color is an important decision criteria: more than 66% of travelers who identify as LGBTQ+ said they choose destinations and travel brands that are welcoming versus only 39% of other travelers.

Likewise, LGBTQ+ travelers (64%) were also more likely to avoid destinations and brands that didn’t align with their social and personal values. According to LGBTQ+ research firm CMI, this is rooted in concerns over safety and the desire to be affirmed when traveling. No one wants to feel unsafe or be discriminated against when they are traveling for leisure.

When and How LGBTQ+ Travelers Book and Share Experiences

LGBTQ+ travelers book last minute: One week booking window

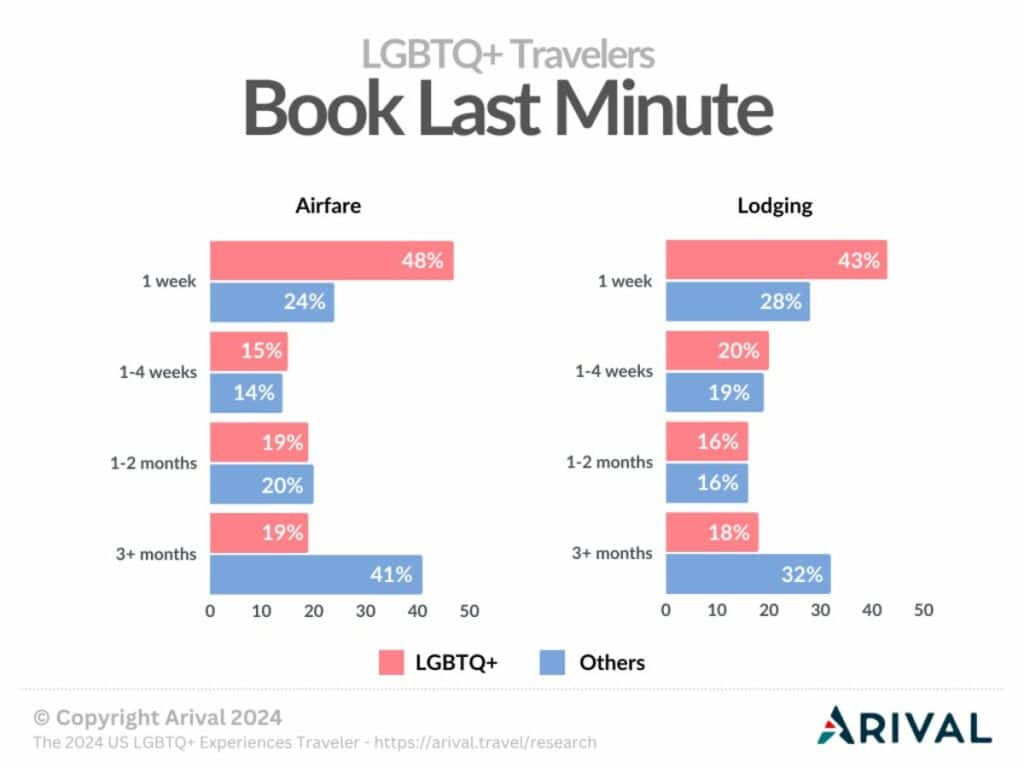

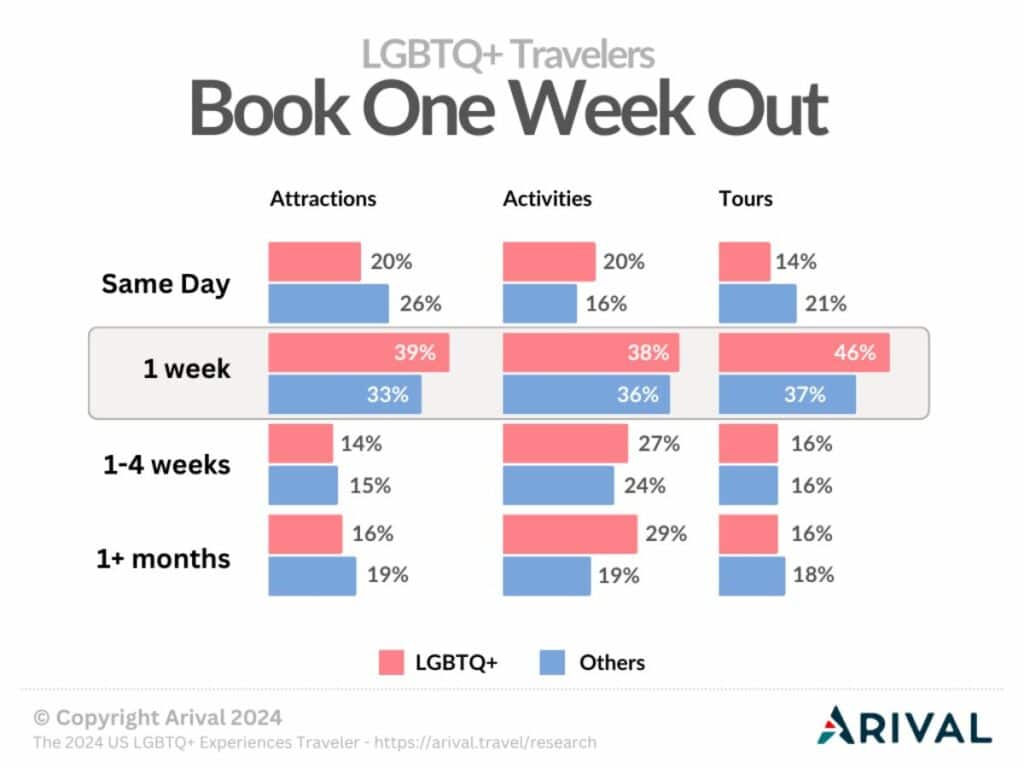

When compared to other travelers, LGBTQ+ travelers prefer to book things last minute. For airfare and accommodations, almost five in 10 LGBTQ+ travelers said that they book only one week before the start of the trip. This may be because the relative young age of LGBTQ+ travelers and their financial affluence offers them the freedom and flexibility to book and travel on short notice.

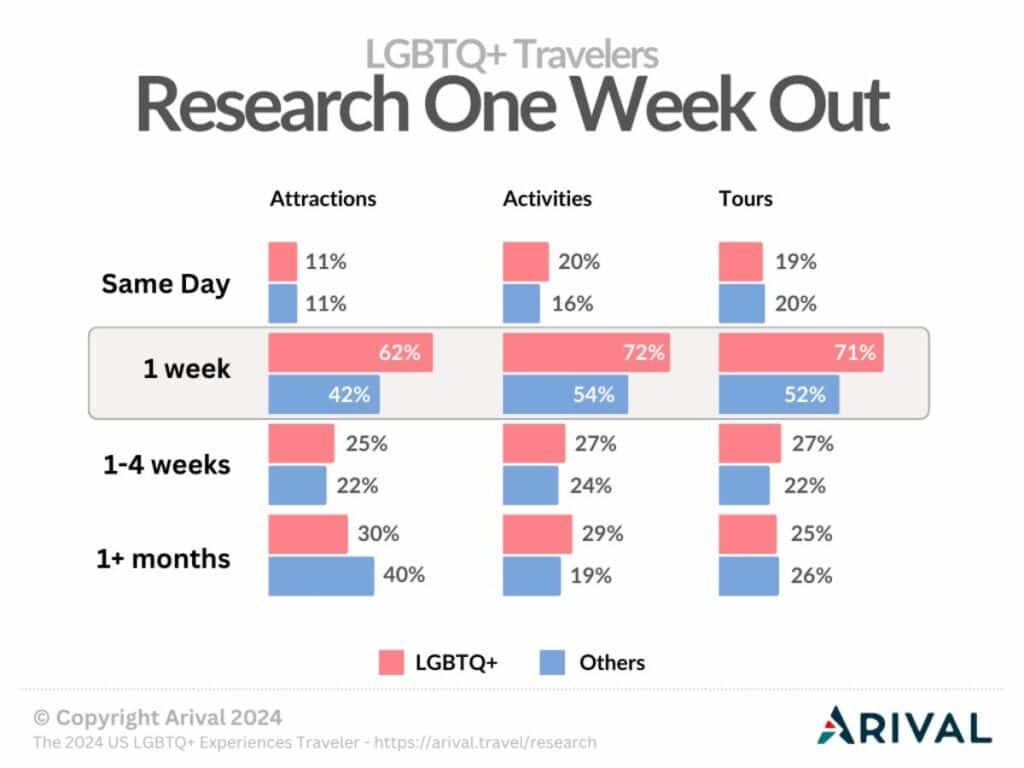

For all experience types, LGBTQ+ travelers tended to research and book tickets one week out. In all cases, LGBTQ+ travelers tended to book a week in advance more frequently than other travelers.

Loud and proud: LGBTQ+ travelers post more reviews and share more on social media

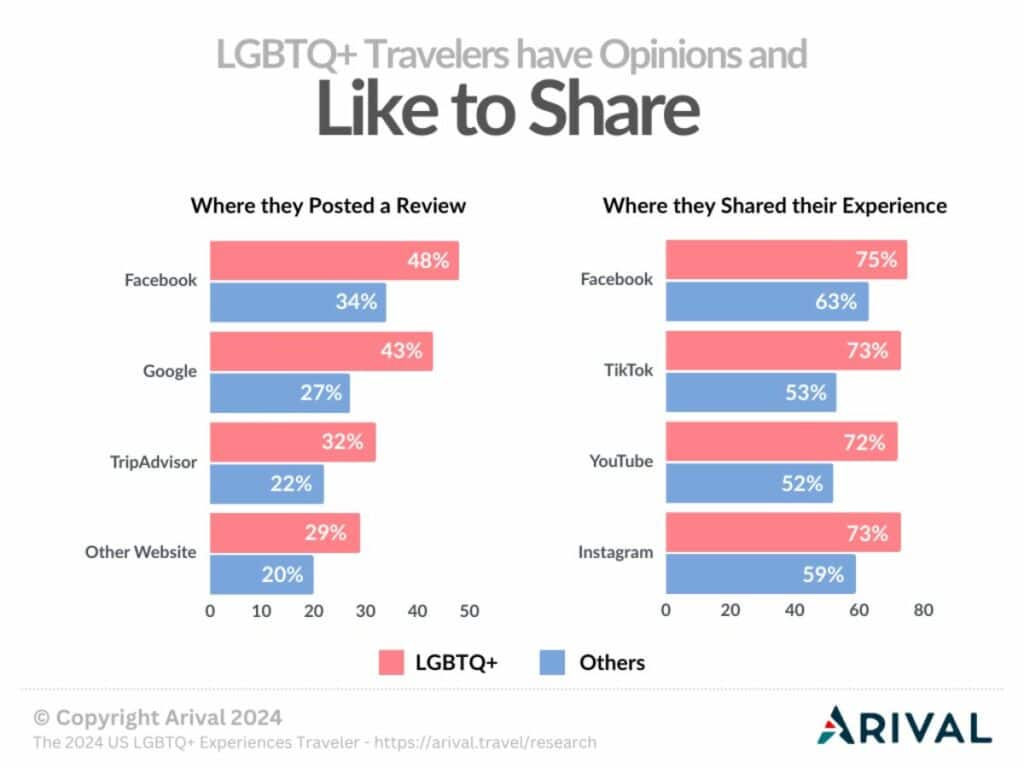

LGBTQ+ travelers are more likely to post reviews online about their experiences. Nearly half of all LGBTQ+ travelers posted reviews on Google, Facebook, or Tripadvisor. This compares to less than three in 10 other travelers who posted reviews.

When it comes to sharing their experiences online, LGBTQ+ travelers are 25% more likely than other travelers to post on video sharing platforms like TikTok, YouTube, and Instagram. When we consider the age of these travelers, it makes sense that they would prefer short form video platforms rather than those used by older travelers. But while age is also a factor, LGBTQ+ travelers generally share more online and post more reviews.

What does this mean for operators? LGBTQ+ travelers can have an outsized impact on your online reviews. Even though LGBTQ+ travelers make up about 10% of the overall traveling public, they are doing upwards of 20% more experiences, spending 20% more, and writing 20% more reviews than other travelers. Ensuring that you provide a positive, inclusive, and welcoming experience for a diverse group of travelers will help to increase your likelihood of positive reviews and the requisite increase in direct bookings and revenues.

Recommendations & Key Takeaways for Operators

Representation and Inclusive Marketing is key. Be sure that your marketing and advertising represents a diverse and inclusive mix of people. If your experiences are family friendly, include all types of families in your photos and videos. Making sure your potential customer base can see themselves represented in your marketing will go a long way to establishing trust in your brand and the confidence to book your experiences.

LGBTQ+ travelers are a growing segment of the experiences traveler market — and they prioritize authentic efforts at inclusivity. Nurturing a strong LGBTQ+ customer base requires more than just cursory advertising during pride month or putting a rainbow version of your logo on social media. LGBTQ+ travelers are keenly aware of their own safety and the steps they must take to avoid the very real threats they may face in unfriendly destinations. Gays, lesbians, bisexuals, queer, and transgender folks all have different needs, sensitivities, and safety concerns. The more operators can do to promote a welcoming and supportive experience for LGBTQ+ travelers, the more likely they are to attract and grow their LGBTQ+ client base. As discussed, LGBTQ+ travelers are much more likely to base their booking decisions on whether a brand or destination is welcoming to them and will actively avoid those that are not.

LGBTQ+ travelers are not a monolith — families with children are a growing sub-segment. Although there is a large portion of travelers who are single or traveling with a partner, there is a larger and growing group of LGBTQ+ travelers traveling with children. Creating supportive and welcoming experiences for a variety of families means increased opportunities to tap into the growing LGBTQ+ family travel market.

LGBTQ+ travelers are a lucrative segment due to their higher-than-average spend — and they are discerning in their travel decisions. The Pink Dollar is real and the impact that LGBTQ+ travelers can have, given their increased spending habits, is significant. But marketing and selling to the LGBTQ+ market without ensuring that your experiences are sensitive to the nuances of the community may not produce the desired results. The LGBTQ+ community is particularly attuned to pink- or rainbow-washing and are not easily taken in by disingenuous marketing.

LGBTQ+ travelers do more experiences — and they value trusted recommendations. Given the number of experiences that LGBTQ+ travelers attend during their trips, it would be prudent for operators to work with one another to provide bundled experiences or at the very least referrals to one another. Trust is an important part of the travel experience, especially among those in the LGBTQ+ community. Having word-of-mouth referrals to other friendly and welcoming businesses can go a long way to helping travelers experience a destination in safety and comfort as well as promoting businesses that are supportive of the LGBTQ+ community.

LGBTQ+ travelers visit amusement parks in greater numbers — numbers that will only grow with their growing families. Large amusement parks have an opportunity to tap into the LGBTQ+ travel market. As reported, there is a large percentage of the LGBTQ+ community that visits amusement parks and as these travelers grow their families, they will continue to travel to these parks with their partners and children.

Learn More About the 2024 Experiences Traveler

The LGBTQ+ Experiences Traveler report is the latest in a series of reports based on Arival’s U.S. consumer research. Look for more reports and articles in this series, focusing on:

Also, join us for the next Arival event to learn more about what travelers are looking for and how to reach them, as we explore the latest travel trends, research results and experiences industry insights, with practical tips and takeaways for operators of tours, activities, attractions and experiences.

Become an Insider Pro Access member today and get access to the full library of Arival research, plus many other benefits such as free consulting sessions, special discounts and 20% off in-person events, starting from $179 per year.

Sign up to receive insights tailored for the in-destination industry as well as updates on Arival.

Header photo: Pexels / Fransa