PARTNER POST | SPONSORED BY GetYourGuide

What’s happening inside the world’s biggest visitor attractions? How do they operate, what technology do they use, and how do they sell their tickets and reach customers?

In our latest report, based on the findings of Arival’s Global Operator Landscape (3rd Ed.) research and developed in partnership with GetYourGuide, we take a closer look at tech, distribution, marketing & product operations of the world’s largest visitor attractions.

This report provides key operating insights on the world’s largest attractions, including the technology they use, how they market and distribute their tickets, and their priorities for new product and commercial initiatives. For attraction operators, this provides critical operating benchmarks, and for tour operators and other organizations seeking to work with visitor attractions, this report is packed with practical guidance and recommendations.

We’re sharing a few highlights from the report below. Download the full report today — available at no cost to Insider Free and Pro Access members.

The Attractions Landscape

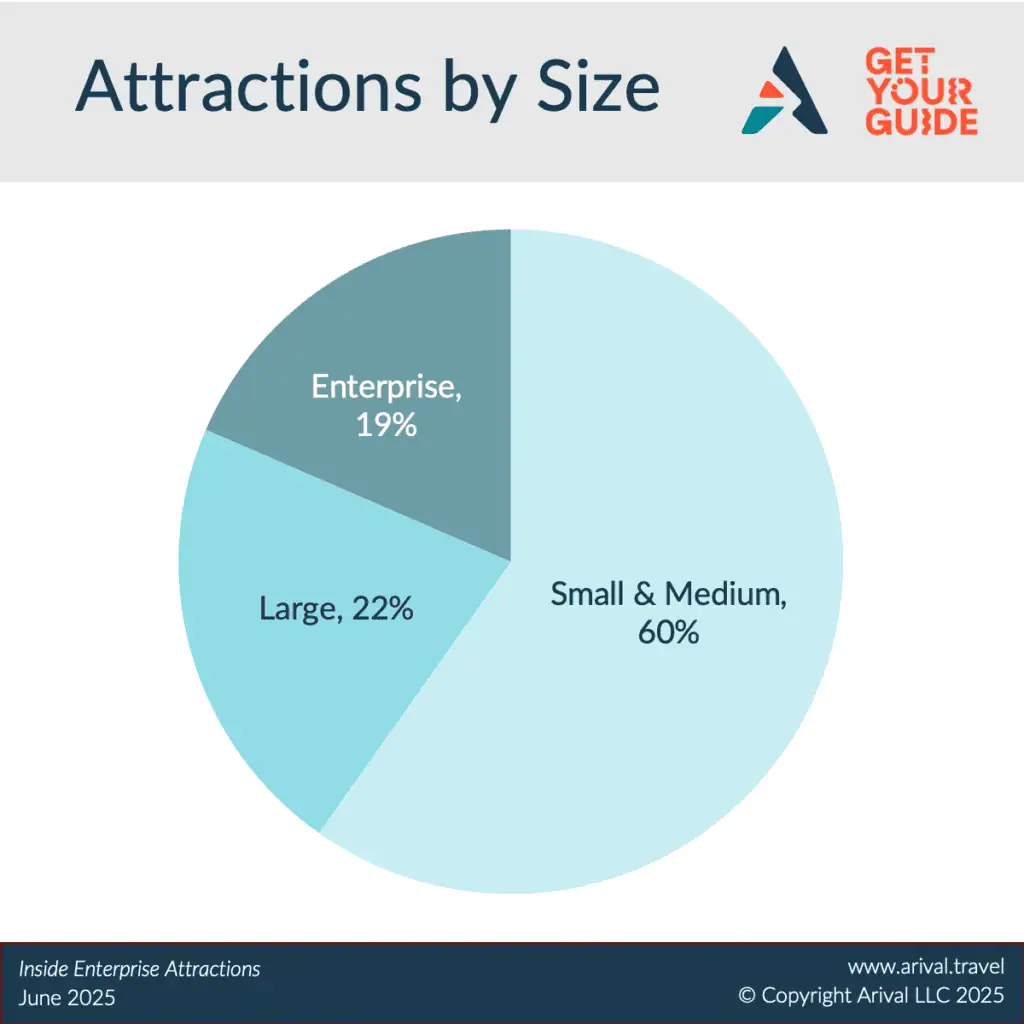

Visitor attractions are key drivers of tourism to destinations. Two in five attractions are large and enterprise-sized operations, serving over 100,000 and 500,000 guests per year, respectively.

Amusement parks, museums, cultural sites and monuments represent the majority of large and enterprise attractions. These attractions also tend to be much older. Three in four enterprise attractions and 68% of large organizations are more than 20 years old.

Big Shift Towards Advanced Booking, Online Ticketing & Timed-Entry

Technological change and shifting consumer trends have shaped all aspects of the guest experience at attractions, from ticketing to product innovation.

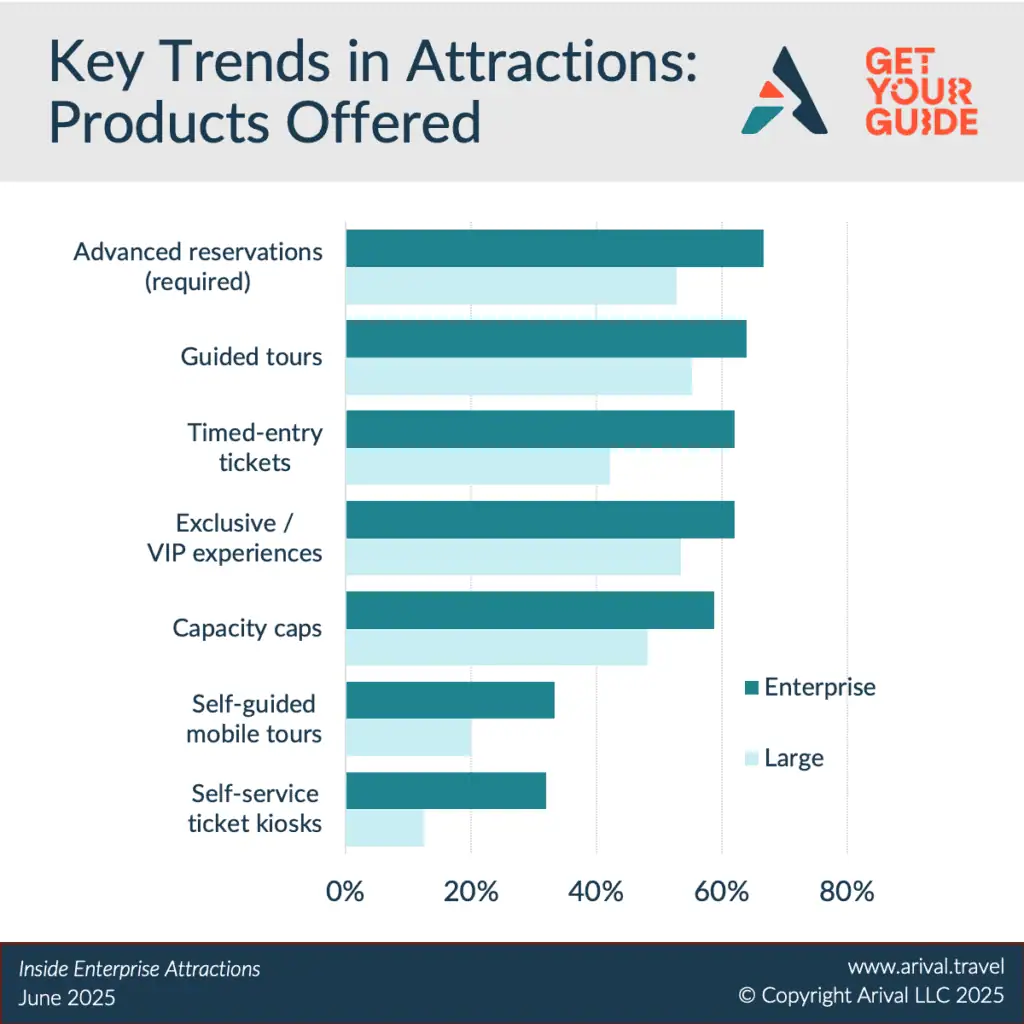

The big shift toward online and mobile ticketing, as well as the need for capacity management among large attractions, has driven the adoption of advanced booking, timed-entry and capacity caps (limits on number of visitors at any one time).

Approximately three in five enterprise attractions and half of all large organizations have implemented these practices.

The growing importance of the affluent traveler segment has also led to a surge in demand for VIP and guided experiences: 62% of enterprise attractions and 53% large attractions already offer these products, and another 16% intend to add VIP experiences and guided tours in 2025.

Here are some resources to look into these trends more closely:

- Learn more about the impact of the affluent traveler in Arival’s The Affluent Experiences Traveler report.

- Hear how some visitor attractions in Australia are collaborating on offering VIP experiences in the Best Part of Travel podcast episode “Koalas, Collaboration and Cultural Attractions.”

- Explore self-guided tours and technology in more depth with the Arival Guide to Self-Guided Tours & Audio Experiences.

Dig Deeper with the Full Report

The latest Arival report delves into the trends, tech, distribution & product operations of the world’s largest visitor attractions and is packed with actionable takeaways both attractions and tour operators working with attractions can implement in their own businesses today. Learn more by downloading the full Inside Enterprise Attractions report, available at no cost thanks to report sponsor GetYourGuide.

Learn More with Arival Research

The Global Operator Landscape (3rd Ed.) Research Series

Arival’s annual survey of the global operator industry is the most comprehensive and in-depth study on travel’s third-largest sector: experiences. Based on a survey of more than 7,000 operators worldwide, the third edition of Arival’s Global Operator Landscape research study informs a series of reports on different sub-segments and geographic regions within the tours, activities and attractions sector.

- Global Operator Landscape: The State of Experiences

- Getting Direct: The State of Digital Marketing

- Global Operator Landscape: The State of Visitor Attractions

- The State of Women+ Leaders in Travel Experiences

- Global Operator Landscape: The Profitable Operator

- Global Operator Landscape: The State of OTAs & Operators

- Inside Enterprise Attractions

- Global Operator Landscape: The State of Booking Tech

Arival thanks our study sponsors: Launch Partner GetYourGuide, and Strategic Insights Partners Catalunya, Expian, Rezgo, Tripworks and Viator, as well as the many Fielding Partners that helped distribute the survey — see the full list here.

Get the full Arival experience by joining us at an upcoming Arival event, and hear the latest research insights and tips on digital marketing for the experiences sector directly from tours, activities and attractions industry leaders and experts.

Become an Insider Pro Access member today and get access to the full library of Arival research, plus many other benefits such as free consulting sessions, special discounts and 20% off in-person events, starting from $179 per year.

Sign up to receive insights tailored for the in-destination industry as well as updates on Arival.

Header photo: Provided by GetYourGuide