If you’ve been feeling like direct bookings are getting increasingly hard to come by, you’re not alone.

In Arival’s latest Global Operator Landscape study, operators reported a decline in direct online bookings, as well as a rise in the share of bookings coming through online travel agencies (OTAs).

Based on responses from more than 5,000 operators worldwide, The Global Operator Landscape (4th Ed.): The State of Experiences offers the most comprehensive view yet of the state and structure of the in-destination experiences marketplace.

While OTAs’ share of bookings has been trending upward for a few years now, outpacing the overall shift to online bookings, this latest study saw the starkest decline of direct website bookings for tour and activity operators.

Share of Online Bookings Shifts in OTAs’ Favor

Operators and OTAs alike have benefited from the overall shift towards online bookings, which has been accelerating for the past several years. However, this growth has levelled off: the overall share of online bookings remained steady at 60% between 2024 and 2025.

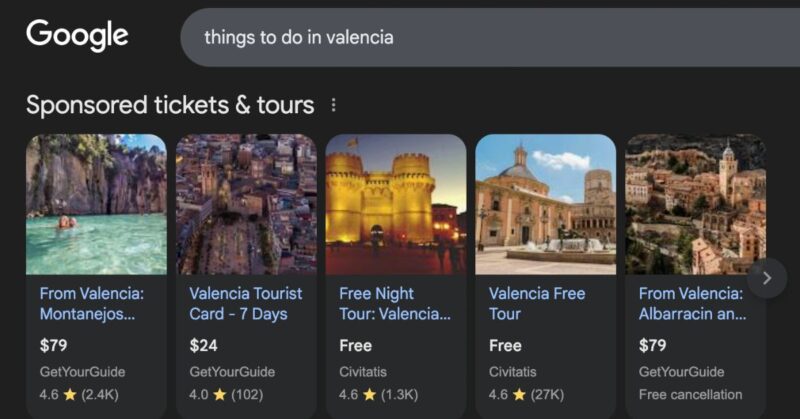

The proportion of online bookings may be holding steady, but the source of those bookings is shifting further towards reseller channels. OTAs continued to gain significant share, surging to 37% of bookings in 2025.

27-29 April 2026

Insider Pro Access Members Save 20%

THE event of the year for the European in-destination experiences industry

Get Your Holiday Season Ticket through 27 January!

Changing the Game: AI, Digital Marketing & Distribution Strategy

Operators’ long-simmering frustration with the rising market power (and commissions) of OTAs is certainly not breaking news. However, the growing challenge of acquiring customers online is due to factors beyond the growing dominance of OTAs.

AI is changing the game, turning the conventional best practices of digital marketing on its head. The rising costs of marketing and advertising paired with the impact of AI on online discovery and booking is upending the path to purchase in favor of larger, more digitally savvy players.

So what’s an operator to do in this increasingly OTA-led, AI-driven era?

Leading operators pursue a balanced distribution strategy to guard against unmanaged dependency (i.e. don’t put all your eggs in one basket):

- Treat OTAs as performance marketing channels, nothing more. They should deliver profitable sales. Learn more about distribution strategy here.

- The direct marketing landscape is harder than ever. Have a realistic strategy that leans in on AI (LLMs) and social media. Check out these resources on using AI in travel marketing, TikTok tips and strategies for tour operators, and marketing with Google.

- Don’t overlook traditional trade channels such as travel agents, DMCs and multi-day tour operators. These categories are on the rise. Learn more about multi-day tours here.

Dig Deeper with The State of Experiences Report

The Global Operator Landscape (4th Ed.): The State of Experiences report is the definitive benchmark study of the global tours, activities, and attractions industry — travel’s third-largest and fastest-growing sector.

Now in its fourth edition, this exclusive report offers the most comprehensive view yet of the state and structure of the in-destination experiences marketplace. It explores how operators are evolving — from sales and distribution to technology adoption, product development, and business outlook — to meet the challenges and opportunities of a rapidly changing industry.

Based on a survey of 5000 operators of tours, activities, attractions and experiences globally, this report reveals key insights into what’s next for tours, activities and attractions, and is available at no cost to Arival Insider Pro Access members.

Become an Insider Pro Access member today and get access to the full library of Arival research, plus many other benefits such as free consulting sessions, special discounts and 20% off in-person events, starting from $179 per year.

Header photo: Pexels / Alain Margreve