Travel companies may be overlooking one of the biggest untapped audiences in the experience economy: event travelers. While these travelers are increasingly booking event tickets online, they’re not doing it through travel websites.

Event and travel booking remain disconnected, the latest Arival report on The Event-Driven Traveler has found. While more and more event-goers are booking their travel online, most of these travelers purchase through event or ticketing platforms, not travel websites.

That’s a missed opportunity. Events are natural anchors for travel decisions — they inspire trips, motivate travelers to extend stays, and inspire spending on myriad other things in-destination. Yet for most event-goers, the booking journey ends once they’ve secured a ticket. Few are drawn into the broader travel ecosystem that could help them turn a single event into a trip full of experiences.

Some travel companies are beginning to catch on. Earlier this year, for example, experiences-focused online travel agency (OTA) GetYourGuide launched support for event tickets, and last week AI travel platform Mindtrip announced they’re adding events to their local experience offerings, signaling growing interest in connecting event and travel experience booking. But for most of the industry, event-driven travel continues to be overlooked.

So why aren’t event travelers booking through travel websites, and what are they doing instead? Here are some highlights from The Event-Driven Traveler report, based on a survey of 2,400 travelers across the U.S. and Europe.

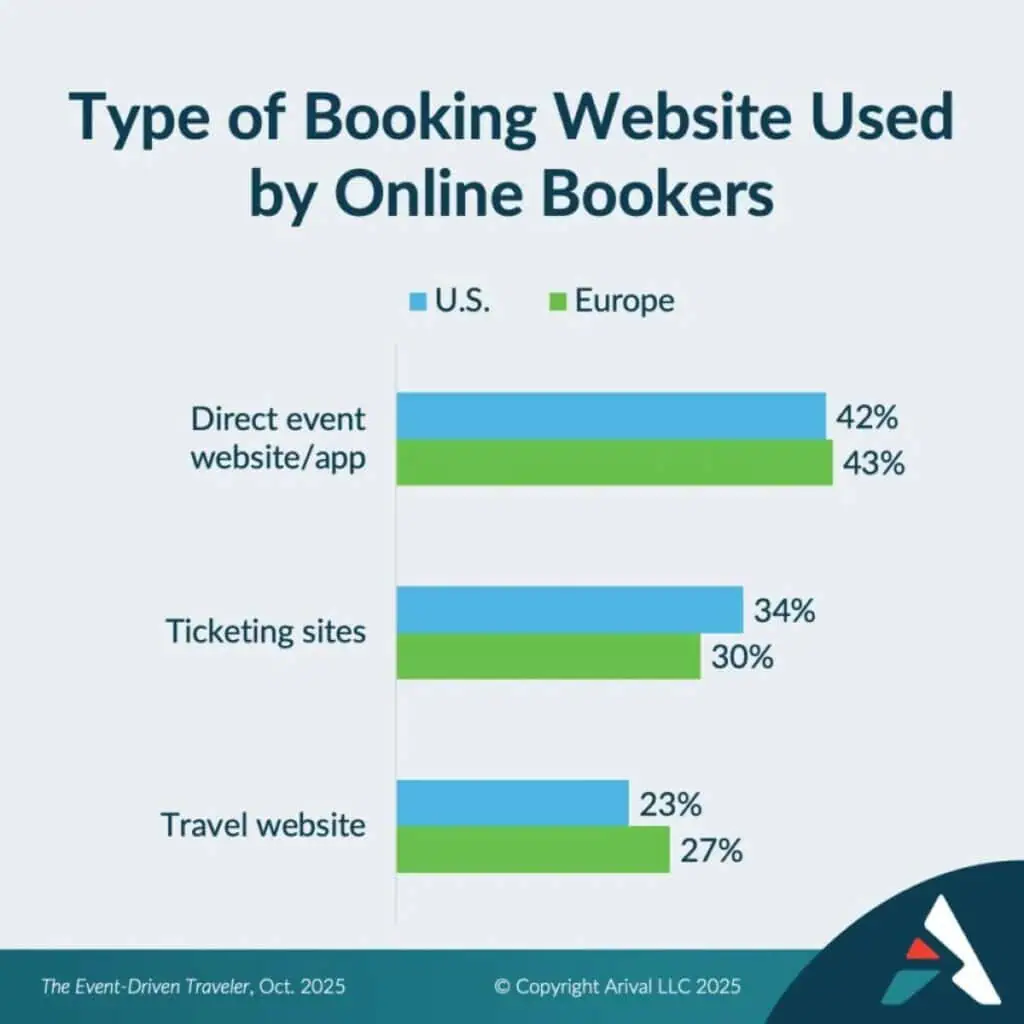

Where Event Travelers Book Online

Gone are the days of lining up at the ticket window, fighting the busy signal or waiting on hold in agony while trying to secure concert tickets by phone. Nearly half of all event travelers now book online, via computer or smart phone — but where they book tells the real story.

Of these online bookers, most head straight to the source – two in five book through official event sites, with ticketing platforms close behind. Travel websites, however, trail behind as the least common online booking source for events.

Why are Travel Websites Underrepresented?

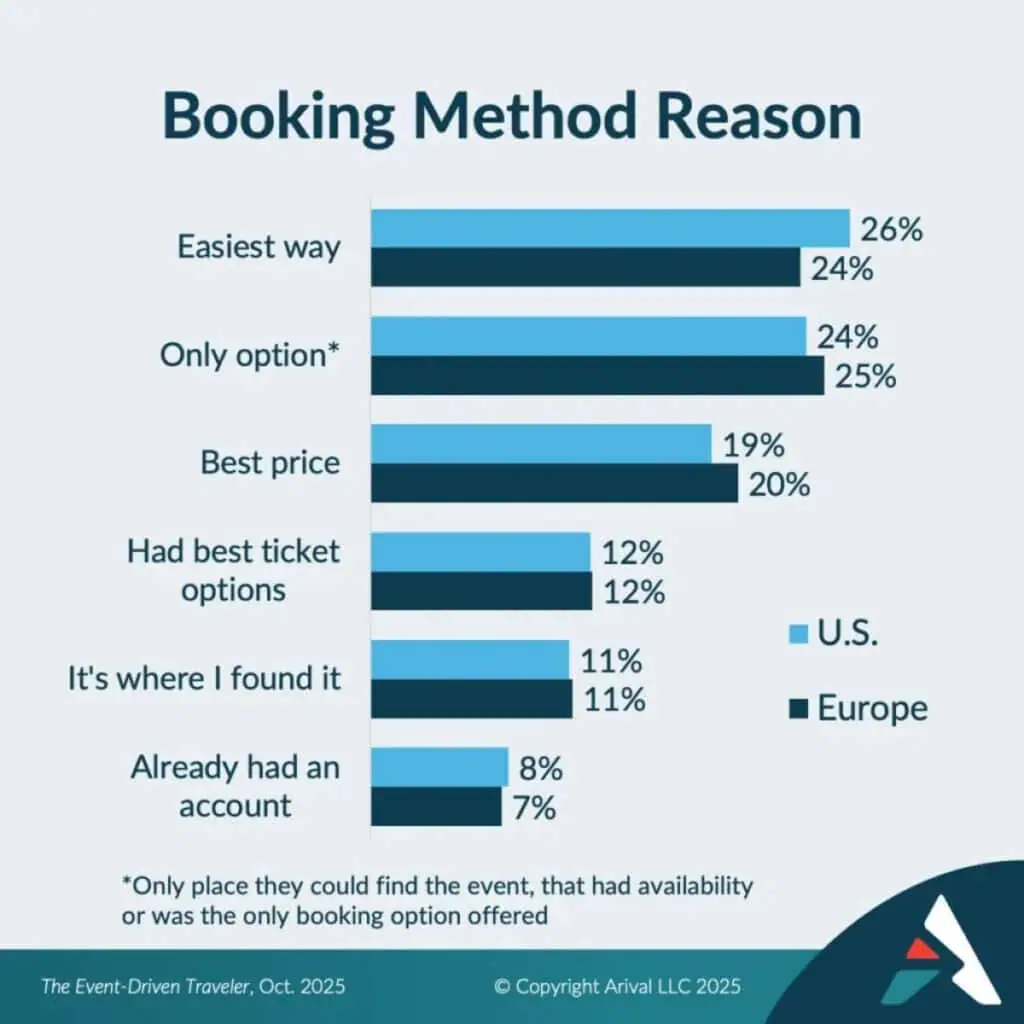

One key reason is access. For many events, particularly sporting events, travelers don’t have the luxury of choice — they book wherever tickets are available. One in four event travelers said they used a specific online booking method because it was their only option: the only place they could find the event, that had availability or that was the only booking option offered.

Another top factor, particularly for performing arts events, is convenience. A quarter of respondents said they booked through their chosen online method simply because it was the easiest way to do so — a factor that ranked higher than price.

Together, these findings highlight a gap: ease and access drive behavior, not price. And those are areas where travel companies, particularly tour and activity platforms, already excel.

Of course, there are challenges to adding events to the travel distribution ecosystem: the product structure of events is very different from most tours and activities. Most events are not recurring products with consistent start times, for example, and require other technical support like multiple ticket types and seat selection. But for companies that are able to rise to the challenge, the event traveler presents a significant opportunity for growth.

27-29 April 2026

Insider Pro Access Members Save 20%

THE event of the year for the European in-destination experiences industry

Save up to €730 with a Holiday Savings Ticket!

The Opportunity for Travel Companies

Events naturally generate travel demand — from festivals and concerts to sports and cultural performances. Every ticket sold represents a potential traveler who needs a place to stay, a way to get around, and things to do before or after the main event.

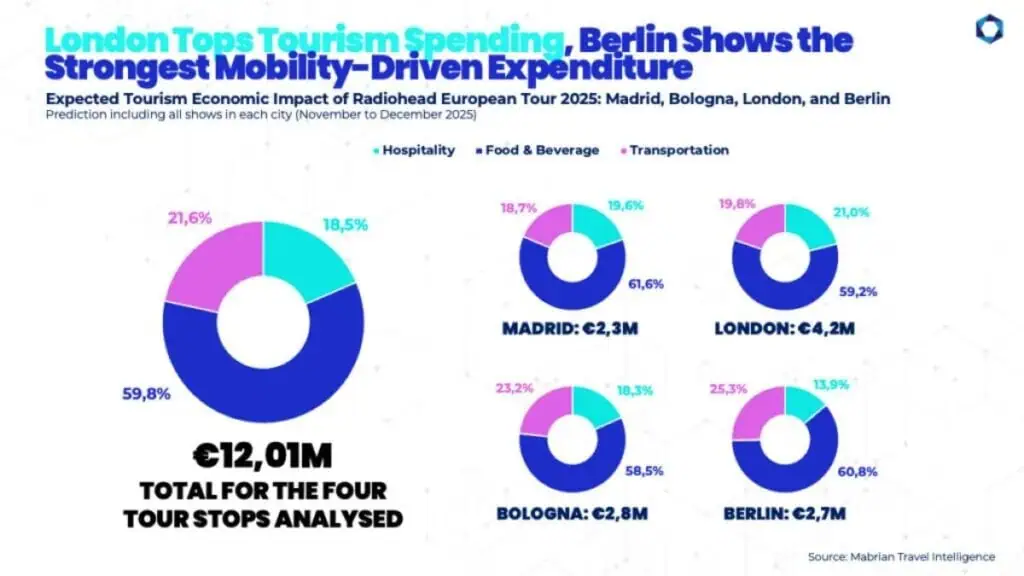

The upcoming Radiohead tour, for example, is projected to bring in over 12 million in tourism spend to the four of the five European host cities included in the tour.

Travel companies that can integrate event content or connect ticketing with other in-destination experiences stand to benefit from capturing that demand. By embedding event ticket options into trip planning and offering seamless booking alongside tours, activities and attractions, they can turn one-off ticket buyers into repeat bookers.

Event travelers aren’t just attending — they’re exploring. The question for companies in the travel sector is whether they’ll explore with you.

Dig Deeper with The Event-Driven Traveler Report

The Event-Driven Traveler report delves inside the minds of U.S. and European travelers to sporting events and performing arts: who they are, what they want, how they shop, and what the travel industry needs to know today.

Based on a survey of 2,400 travelers across the U.S. and Europe, this report is an essential resource for creators, sellers, technology providers, marketers, travel advisors and packagers of events for travel, including performing arts, sporting events and festivals.

Learn More with Arival Research

The 2025 Experiences Traveler Research Series

This consumer research series delves into the wants, preferences, attitudes and buying habits of the U.S. experiences traveler. Based on a survey of 2400 travelers from across Europe and the U.S., this series of reports examine different aspects of the tours, activities and attractions traveler: who they are, what they book, why they book and what they want, how and when they book, what matters most to them, and much more. This is an essential research series for any creator or seller of in-destination experiences in the U.S. and Europe.

Find the full list of publications in this research series here:

Get the full Arival experience by joining us at an upcoming Arival event. Be the first to hear about the latest consumer and industry research insights, and stay up to date on the latest traveler trends in the experiences sector directly from tours, activities and attractions industry leaders and experts.

Become an Insider Pro Access member today and get access to the full library of Arival research, plus many other benefits such as free consulting sessions, special discounts and 20% off in-person events, starting from $179 per year.

Sign up to receive insights tailored for the in-destination industry as well as updates on Arival.

Header photo: Pexels / Andrea Piacquadio