The travel industry loves to talk about trends. From heatwave-escaping “coolcations” to beauty-chasing “glowmads”, there is no shortage of catchy portmanteaus floating around out there. But what is really going to drive the future of the travel experiences sector goes beyond tired buzzwords and newly-minted fads.

On September 29, 2025, Arival assembled 100 senior industry leaders in Washington DC for the inaugural Executive Summit on The Future of Experiences. They discussed everything from economic shifts and geopolitical upheaval, to AI and rapidly changing technologies, to overtourism and rapidly shifting consumer behavior, and how all of these will impact operators of tours, activities, attractions and experiences in the months and years ahead.

Here are some of the highlights from that discussion. Please note, this is far from a comprehensive list. For a full overview of the executive summit’s resulting themes and megatrends, download the summary report here.

Technological Acceleration: AI & the Exponential Shift

We’d be remiss if we didn’t start with technology in general, and AI in particular. Indeed, technology in travel is accelerating faster than ever. Advances in AI, automation, and immersive digital tools are transforming how travelers discover, book, and enjoy their trips, reshaping operations and challenging the very conception of what makes an “experience.”

- AI Travel Planning: AI agents are increasingly able to deliver hyper-personalized recommendations, changing how experiences are discovered and booked, and challenging traditional search and marketing methods.

- Automation & Operations: Operators are using AI to streamline back-office tasks like pricing, scheduling, and content creation, letting teams operate more efficiently while preserving human creativity.

- Digital + Physical Fusion: AR, VR, and AI-guided experiences blur the line between digital and physical travel, expanding possibilities for personalization, scale and access.

So what does this mean for operators? Operators must rethink their product and distribution strategies for an AI-first era. See How Operators are Using AI, 5 Tour Operator Use Cases for AI & Automation, and Becoming an AI-First Company.

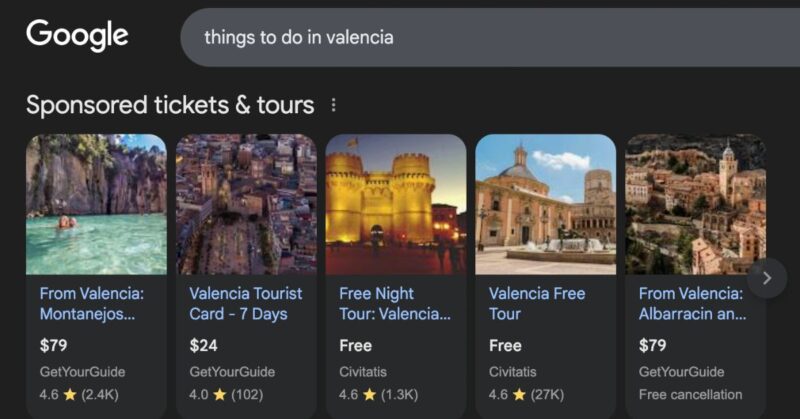

The Rapid Rise of OTAs & the Rising Cost of Direct

It’s one of the most commonly discussed topics at Arival events: working with OTAs. Online travel agencies (OTAs) help operators reach new audiences and greater levels of profitability. However, as they continue to grow, OTAs are capturing a larger share of bookings while pushing up commissions and contributing to the commoditization of experiences (see next point). Operators, meanwhile, face rising costs and increasing complexity in acquiring customers directly, as digital marketing becomes more competitive and AI disrupts traditional search channels.

- Accelerating OTA Dominance: OTAs standardize and scale tours to drive conversion, creating tension with operators who seek to differentiate and offer unique experiences.

- Direct Booking Challenges: Growing direct bookings is a top priority for operators, Arival research consistently shows, but rising ad costs and unpredictable social channels compounded with the continued rise of OTAs make it increasingly difficult.

- AI and Search Disruption: AI-powered summaries and Google’s AI Mode are transforming search behavior, making visibility in AI-driven discovery essential for operators.

So what does this mean for operators? Every experience business must be investing in how their businesses and offerings can be surfaced across AI apps and AI-powered search. See AI Mode for Operators and OTAs, Direct vs. OTAs: Who Will Win in the AI Era, and the Propellic study on the impact of AI Mode.

The Commoditization of Experiences

How do you stand out above the rest? As the experiences sector grows, so do the challenges of differentiation. Travel experiences aim to be memorable, meaningful and even transformational, emphasizing uniqueness, authenticity, and storytelling. Yet for most travelers, convenience—schedule, location, and price—still drives purchase decisions, blending emotional appeal with transactional behavior.

- Experience Differentiation: Operators focus on authenticity, quality guides, and storytelling to stand out in a crowded market.

- Purchase Drivers: Despite aspirations towards offering transformational experiences, most bookings are guided by convenience and cost rather than uniqueness.

- Operational Excellence: Marketing, technology, and operational efficiency are critical to compete in an increasingly competitive, digital-first environment.

So what does this mean for operators? The key to standing out is in both offering differentiated experiences, but also delivering those experiences with excellence. See Escaping the Tour Commoditization Trap, How to Stand Out on OTAs, and The Rise of the Transformation Economy.

13-16 Oct 2026

Insider Pro Access Members Save 20%

THE event of the year for creators and sellers of destination experiences to connect, learn & grow.

Get YourSuper Early Bird Ticket Through 13 January!

Economic Inequality, Power Shifts & the New Global Consumer

Who will your future customers be? The question might be more complicated than you think. The global economy is shifting structurally, with widening wealth gaps, a rising middle class in Asia, and increasing economic and geopolitical uncertainty. For experience operators, this may change who your customers are, where they come from, and what they expect.

- Bifurcated Travel Market: Both luxury and low-cost experiences are thriving, while mid-tier offerings struggle, forcing operators to choose a focus or diversify product tiers.

- Asia’s Middle Class: By 2030, Asia will drive much of global travel demand, requiring experiences to adapt in language, service, and cultural relevance.

- Deglobalization & Regional Travel: Trade tensions, tariffs, and travel restrictions may regionalize tourism, making resilience in local and regional markets increasingly important, particularly for the U.S.

So what does this mean for operators? Experiences must evolve to serve a bifurcated market – premium, values-driven travelers on one end, and cost-conscious, digital-first travelers on the other. Ask yourself: Are your experiences designed for the future premium segment — or the value-driven mass market? Can you diversify product tiers to serve both? Or should you go all in on one? See How Affluent Millennials are Changing Travel Planning, The Quest for Service-Level Tiers in Tours & Experiences, and More Attractions Offer Guided Tours, VIP Experiences.

Climate, Crowds & the Future of Access

From extreme weather to overcrowding, the challenge of managing tourism in popular destinations is heating up. Climate change, overtourism, and rising destination restrictions are reshaping where and when people can travel. For operators, this is both a challenge and an opportunity: bestselling, popular experiences may not remain viable in the long term, while new locations and strategies can define the future map of travel.

- Limits at Top Destinations: Iconic sites face closures, capacity restrictions, and climate impacts, creating friction for travelers and operators alike.

- Dispersal Strategies: Cities and DMOs are promoting lesser-known areas, while travelers increasingly seek “hidden gems” and authentic, off-the-beaten-path experiences.

- Strategic Implications: Tour operators and attractions who adapt—innovating their offerings, dispersing demand, and investing in community relationships—will thrive, while those reliant on mass access to top attractions face growing fragility.

So what does this mean for operators? The pressures of overtourism are real—but so are the opportunities to shape a new era of high-value, place-based, and sustainable travel experiences. See Beyond Capacity: Managing Demand at Europe’s Top Attractions, Key Trends in Large Attractions, and this podcast interview with Intrepid Travel’s CEO on climate strategy and the growth of small group tours.

IRL – De-digitalization in the Age of AI

“Let’s take this offline.” We started this article out with AI, so it’s fitting we end it with humans. As screen fatigue and algorithm overload grow, travelers are seeking more offline, in-person, “In Real Life” human experiences. For the tours, activities, and attractions sector, “IRL” isn’t just a trend—it’s a strength, and a strategic signal of rising demand for tangible, human-led engagement.

- Offline Preference: Gen Z and other travelers increasingly crave hands-on, device-free interactions that feel real and facilitate in-person social engagement.

- Value of Presence: Physical, embodied experiences strengthen connection and satisfaction compared with digital-only offerings.

- Strategic Opportunity: Tours and experiences that reduce screen reliance and emphasize immersion, discovery, and human connection will stand out.

So what does this mean for operators? If travelers are craving offline, hands‑on engagement, then the value proposition of live, physical, human‑led experiences strengthens—while purely digital or virtual offerings may lose edge. See The Multi-Day Moment and Younger Tour Takers Driving Shift to Social Travel.

27-29 April 2026

Insider Pro Access Members Save 20%

THE event of the year for the European in-destination experiences industry

Save up to €730 with a Holiday Savings Ticket!

Looking Ahead: Travel Experiences in 2026 and Beyond

From AI-driven discovery and automation to the continued rise of OTAs, from increased economic and climate pressure to the greater demand for human-focused “IRL” experiences, one thing is clear: travel experiences must evolve. Operators who embrace technology, diversify their offerings, and design meaningful experiences will be best positioned to thrive.

To explore these themes and megatrends in greater depth and uncover additional insights, download the full Arival report.

Join the conversation in person at the next Arival event and request an invite for the 2026 Executive Summit in Valencia, where we’ll be continuing to gather industry leaders to discuss how these themes are impacting operators in real time, and most importantly: what to do about it.

Become an Insider Pro Access member today and get access to the full library of Arival research, plus many other benefits such as free consulting sessions, special discounts and 20% off in-person events, starting from $179 per year.

Sign up to receive insights tailored for the in-destination industry as well as updates on Arival.

Header image: Pexels / Nandhu Kumar