Whether it’s for Taylor Swift or the Toronto Blue Jays, more and more travelers are planning trips around events — younger travelers in particular. Nearly half of U.S. travelers aged 18–34 and two in five in Europe say an event was a big factor in the destination decision, Arival’s latest consumer research has found.

Not only are events motivating these travelers to travel more, but they are spending more on those trips, including on elevated experiences beyond the arena. So how can you attract traveling fans to spend on your experience offerings?

The Event-Driven Traveler report delves inside the minds of U.S. and European travelers to sporting events and performing arts: who they are, what they want, how they shop, and what the travel industry needs to know today. Based on a survey of 2,400 travelers across the U.S. and Europe, this report is part of a series of essential reports for any creator or seller of in-destination experiences serving European and U.S. European travelers.

Events Drive the Travel Journey for Younger Travelers

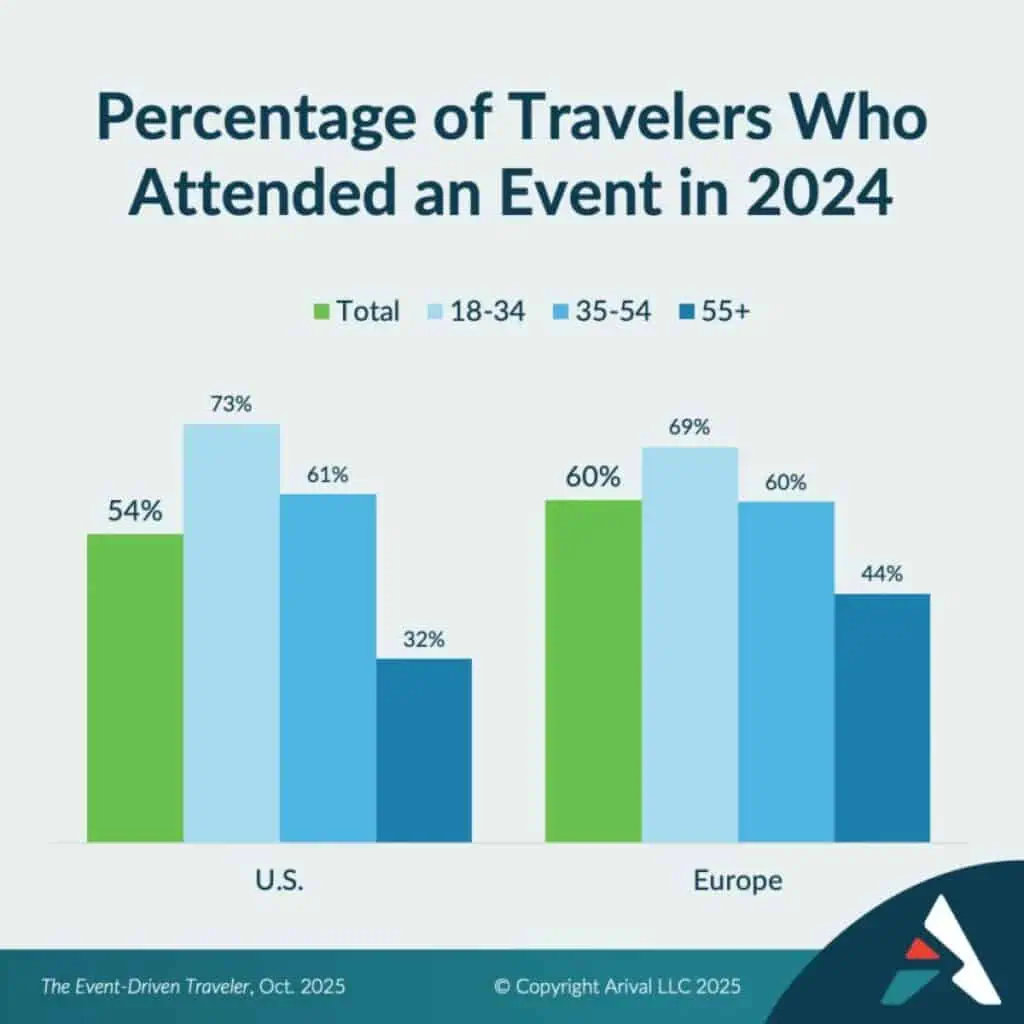

While travelers of all ages enjoy attending events such as performing arts and sports games/matches, event travel is fueled by young travelers, with mid-age travelers a close second.

Seven out of 10 younger millennial and Gen Z (18-34) travelers and six out of 10 older millennial and younger Gen X (35-54) travelers attended an event while on a trip in 2024. Sporting events were the most commonly attended: four of the top five events travelers attended were sports-related (see the full report for more details on events attended and specific breakdowns by age and region).

27-29 April 2026

Insider Pro Access Members Save 20%

THE event of the year for the European in-destination experiences industry

Save up to €610 with a Winter Special Ticket!

What Event Travelers Spend Their Money On

Events encourage travelers to spend more, and not only on the event itself: travelers spend on everything from hotels to transportation to food and beverage… and, yes, experiences.

The “Taylor Swift Effect” of boosting local economies is well-documented — it’s estimated that the artist’s latest “Eras” tour injected over five billion dollars into local tourism economies in the first five months, with fans spending an average of $1300 per concert-goer.

While this is significantly higher than average — young (18-34) event travelers reported an average of $247 spend per person per event for U.S. travelers and €221 for European travelers in the Arival study — the numbers add up to real economic impact for destinations.

So what are fans spending money on?

For travelers to sporting events especially, it’s about more than just the match. Sports audiences value everything surrounding the moment, and will spend more to enhance their trip with fan experiences and pre-and post-event activities.

Operator Takeaway:

Some innovative operators have found ways to attract traveling fans. For example, a tour guide in Barcelona offers an experience to “Discover Leo Messi’s Secrets” and GetYourGuide has developed an Originals tour of “Taylor Swift’s New York Hot Spots.” Many venues themselves also offer elevated experiences for fans that go beyond public tours, such as Arsenal football team’s VIP Legend Experience that takes you behind-the-scenes of Emirates Stadium with a pitch-side commentator and a “VIP Legend,” and Sydney Opera House’s “Taste of Opera” experience that includes a private opera recital.

How can you tap into the event-driven travel trend? Consider how you can offer elevated experiences tailored to traveling fans, whether related to a local sports team, or a popular artist who has some connection to your destination.

Dig Deeper with The Event-Driven Traveler Report

The Event-Driven Traveler report delves inside the minds of U.S. and European travelers to sporting events and performing arts: who they are, what they want, how they shop, and what the travel industry needs to know today.

Based on a survey of 2,400 travelers across the U.S. and Europe, this report is an essential resource for creators, sellers, technology providers, marketers, travel advisors and packagers of events for travel, including performing arts, sporting events and festivals.

Learn More with Arival Research

The 2025 Experiences Traveler Research Series

This consumer research series delves into the wants, preferences, attitudes and buying habits of the U.S. experiences traveler. Based on a survey of 2400 travelers from across Europe and the U.S., this series of reports examine different aspects of the tours, activities and attractions traveler: who they are, what they book, why they book and what they want, how and when they book, what matters most to them, and much more. This is an essential research series for any creator or seller of in-destination experiences in the U.S. and Europe.

Find the full list of publications in this research series here:

Get the full Arival experience by joining us at an upcoming Arival event. Be the first to hear about the latest consumer and industry research insights, and stay up to date on the latest traveler trends in the experiences sector directly from tours, activities and attractions industry leaders and experts.

Become an Insider Pro Access member today and get access to the full library of Arival research, plus many other benefits such as free consulting sessions, special discounts and 20% off in-person events, starting from $179 per year.

Sign up to receive insights tailored for the in-destination industry as well as updates on Arival.

Header photo: Unsplash / Stephen Mease